While U.S. stock markets are close to break-even for the year, domestic equity funds have seen major outflows in 2015. According to a December 16th report from Credit Suisse Equity Trading Strategy, outflows from U.S. equity markets are on a record pace. Edward K. Tom and the rest of the CS team highlight that last week marked the 11th straight week of outflows for domestic mutual funds.

Recent U.S. equity fund highlights

The CS report points out that U.S.Exchange Traded Products saw net outflows of $2.6 billion in the second week of December as a number of higher risk asset classes such as high yield bonds saw notable withdrawals.

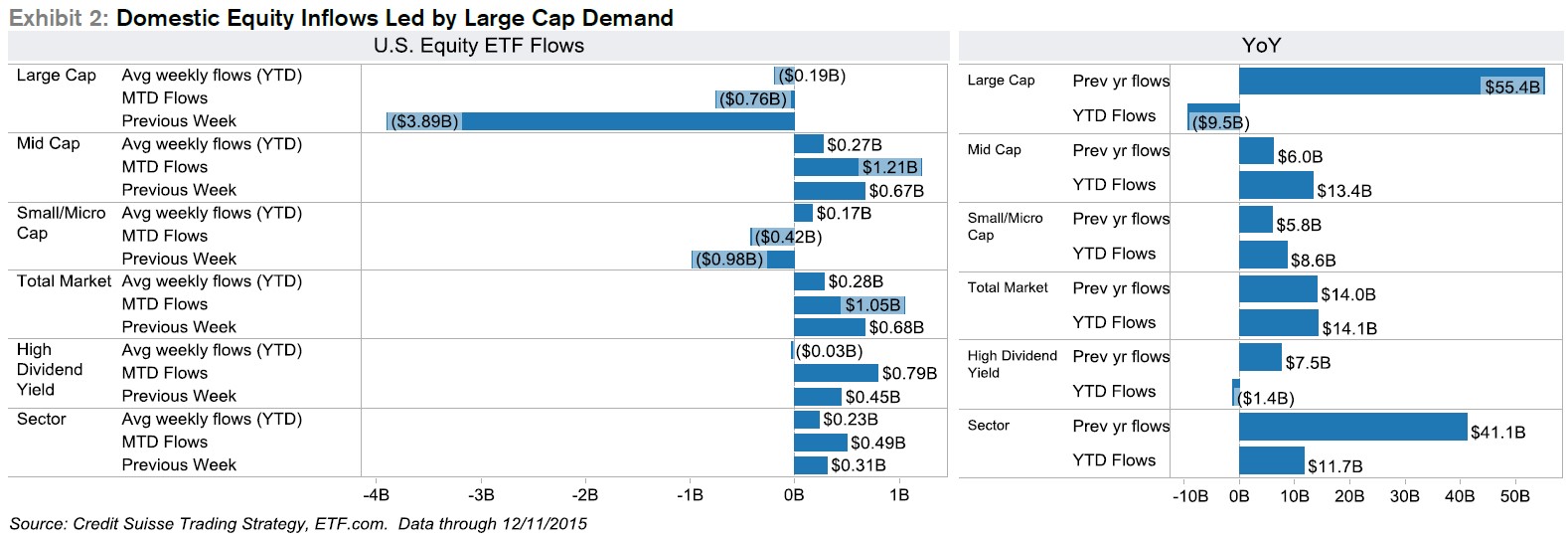

Domestic equity ETPs saw net outflows of $2.8 billion with significant redemptions in the large and small cap space last week. Also of note, U.S. equity mutual funds saw an 11th straight week of outflows, meaning that total outflows for the year so far have topped $161 billion which is just a hair under total outflows in 2008.

On the other hand, international equity ETP inflows were close to $1.4 billion last week, as buying in Developed Markets outside of the U.S. remained strong. That said, global equity mutual funds had their largest weekly outflow so far this year at $1.2 billion.

Of interest, Fixed Income ETPs saw net outflows of $2.3 billion last week, with massive redemptions in high-yield bond funds.

In terms of developments in the lending market, shorting EEM (Emerging Markets), EWZ (Brazil), and USO (oil) got cheaper. On the other hand, the cost to borrow increased for OIH (oil service companies), OIL (oil ETN) and XOP (O&G exploration and production companies).

Developments in ex-US mutual funds and ETFs

Tom and colleagues also note that there were strong flows into funds tracking EAFE ($1.6 billion) in ex-U.S. Developed Markets. That said, outflows in ETPs following Japanese equities moved above $427 million.

Emerging Market finally started to attract some interest last week, with net inflows of just over $111 million, with investors re-entering across a wide range of EM ET products.

Leave A Comment