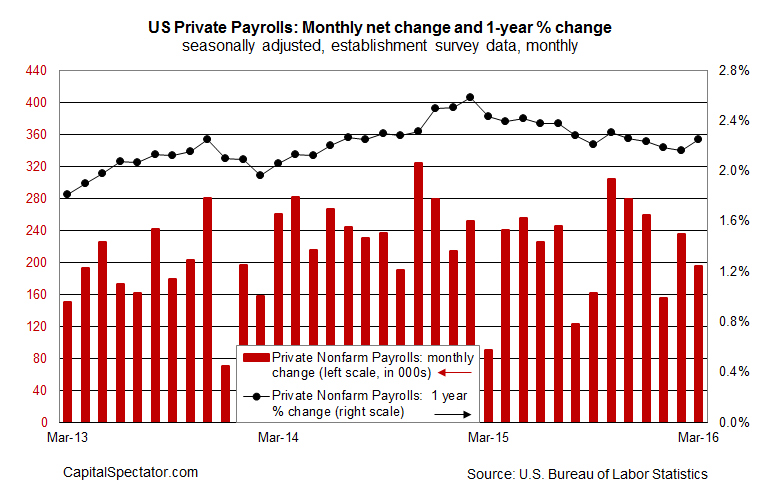

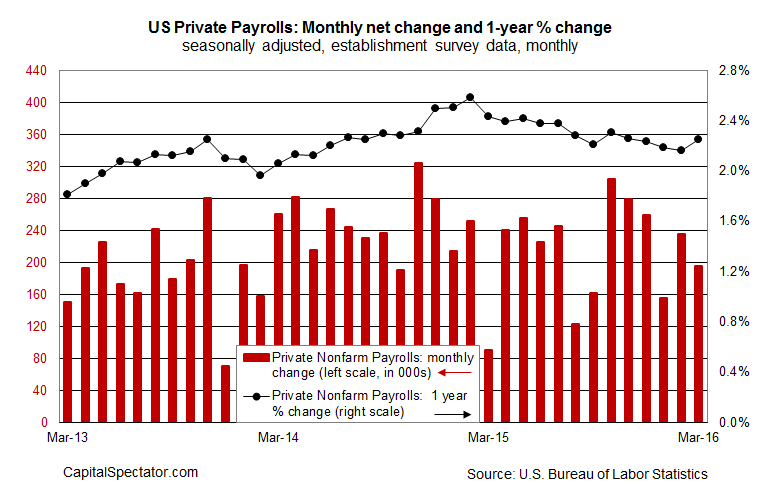

Private payrolls in the US increased 195,000 in March (seasonally adjusted), a moderately lower gain vs. February’s 236,000 advance, according to this morning’s update from the Labor Department. But the year-over-year trend improved, pointing to sustainable and healthy growth for the labor market in the near term.

The annual pace for payrolls at US companies ticked up to 2.25% vs. the year-earlier level. The slightly faster year-over-year increase marks the first improvement in the annual trend in five months. As a result, private payrolls posted the strongest annual rise since last November. If anyone’s still talking about an imminent recession signal for the US economy, they’re not looking at the annual changes for payrolls for insight.

“We’ve been through some rough patches, but we continue to generate a lot of jobs,” Ward McCarthy, chief financial economist at Jefferies LLC, tells Bloomberg. “In a consumer-driven economy, that’s going to keep us headed in the right direction.”

It’s been clear for weeks that recession risk remained low through last month–a view that was effectively confirmed in the preliminary numbers via the US macro profile for February. Although there’s still a long way to go for March data, today’s update is effectively a down payment on expecting that February’s upbeat profile will spill over into the first quarter’s final month. The manufacturing sector is still weak, but for the moment the troubles in that corner remain relatively contained and pose little immediate danger for the broad economy–based on numbers published to date.

“It was another solid report,” observed Curtis Long, chief economist at National Assoc. of Federal Credit Unions, via Reuters. “We continue to see the trend of people reentering into the workforce.”

Leave A Comment