For the second straight quarter, the Bureau of Labor Statistics (BLS) estimates US productivity growth was less than 1%. That’s not surprising given the weakening in output as measured by GDP, the data reported by the Bureau of Economic Analysis (BEA). Productivity is the bridge between the BLS’s labor numbers and the more general economic assessments of the BEA (Private Output – Total Hours Worked = Productivity).

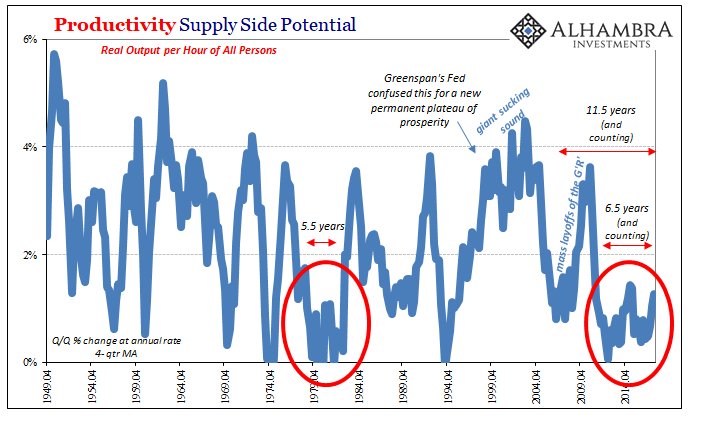

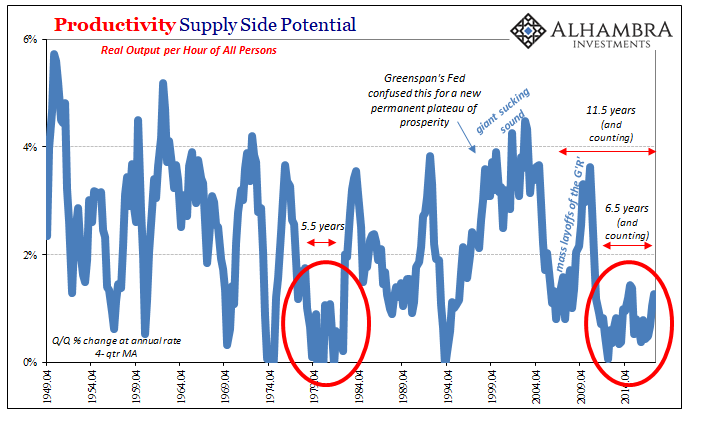

For a very long time now, US productivity has been stagnant. That’s a huge drag on economic performance, though Economists are stumped as to why that was and continues to be. It’s as if US companies don’t want to invest productively in their businesses, preferring to buyback shares and hold the most liquid financial assets instead. These are the actions of companies that foresee little economic opportunity.

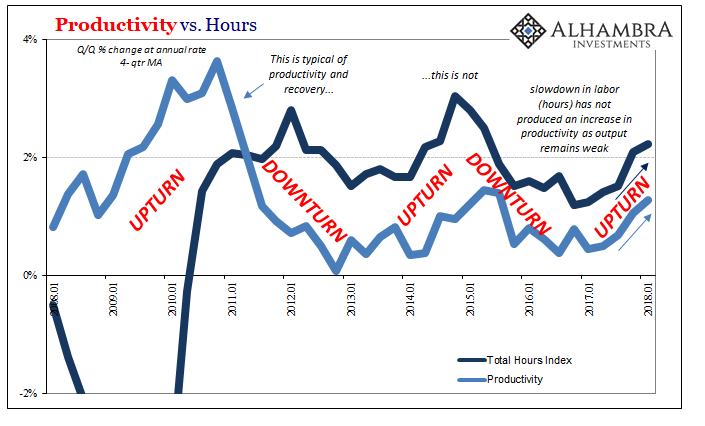

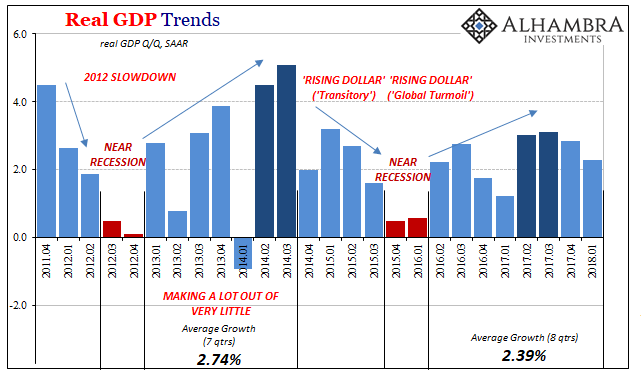

One big reason they might feel that way is given to us by these very figures. In the context of a business cycle, what firms want to see after contraction is stability more than anything – the idea that the economy will recover and then continue on that way. Setbacks are devastating in any fragile environment. The last thing anyone wants, particularly when considering potentially costly investments, is for unevenness. That’s especially true when it happens “unexpectedly” yet consistently.

The result is not just uncertainty which gains with each mini-cycle, but also this ratchet effect whereby every upturn is lesser than the one previous. The economic ceiling, so to speak, is reduced each time and the negative effects become cumulative. You can see it at each one of the three peaks above, particularly the last two.

Against this unsteady (at best) backdrop, how in the world does anyone expect wage growth would be accelerating? It’s absolutely amazing that the Federal Reserve and mainstream Economists (redundant) are actually trying to make the case that wage growth is not just a given but is threatening to get out of hand (overheating). It’s plain absurd.

Leave A Comment