Ethereum Market Overview: Switzerland’s two major banks, UBS and Credit Suisse along with others are about to improve their data quality by using Ethereum. Meanwhile, a potentially dangerous fake version of MyEtherWallet is in the App Store. How is the Ethereum market reacting? Here is a quick overview.

Ethereum Market Overview

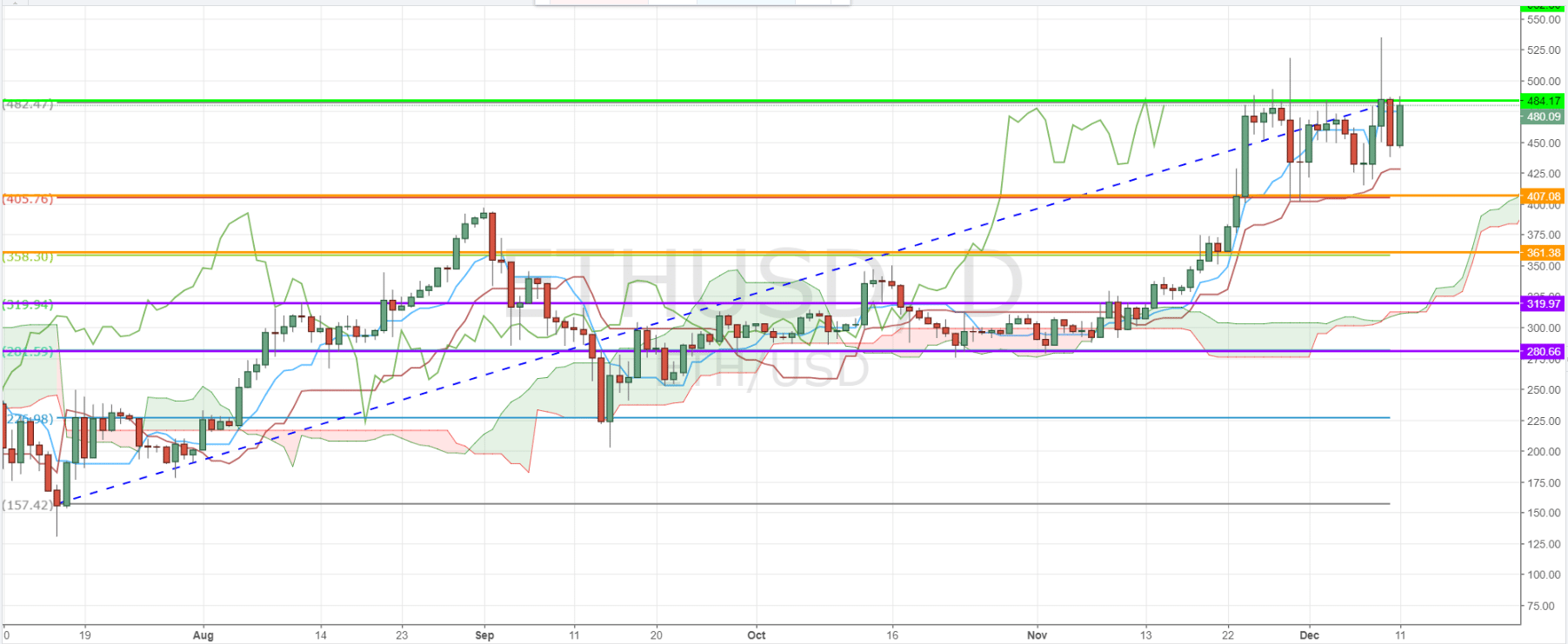

After a big day for Bitcoin in the futures market, Ethereum still struggles to break above the key resistance level of $484.

Ethereum is the second largest cryptocurrency by market cap. Many investors consider it Bitcoin’s direct competitor. However, Ethereum’s price is nowhere as volatile as Bitcoin. Therefore, Ethereum is less likely to be driving up in a bubble. It also might carry less crash risk as of today.

The Ethereum market started Tuesday off on a bullish momentum, testing the $484 level once again.The pivot levels are set at 23% and 38% Fibonacci retracement levels of $407 and $361 respectively.Meanwhile, a confirmation of a break above $484 could open doors for further gains for ETH/USD towards new highs in the $562 area.

The Ethereum market continues to move above the daily Ichimoku cloud.

UBS to Launch Live Ethereum Platform

On the corporate side, some of the largest banks in the world have revealed a pilot designed to simplify compliance using Ethereum.

The project was born out of UBS’ London-based fintech laboratory.Now they have help from Barclays, Credit Suisse, KBC, SIX and Thomson Reuters.

The platform is called the Massive Autonomous Distributed Reconciliation, AKA Madrec. It is designed to make it easier for banks to reconcile a large amount of data about their counterparties.

The Madrec pilot is currently in a mock-live environment using 22,000 non-sensitive reference attributes for cash equity issuers.

The new initiative is set to bring data from Switzerland’s and Europe’s biggest banks into line ahead of the second varnish of MiFID, which comes into effect in January.

Leave A Comment