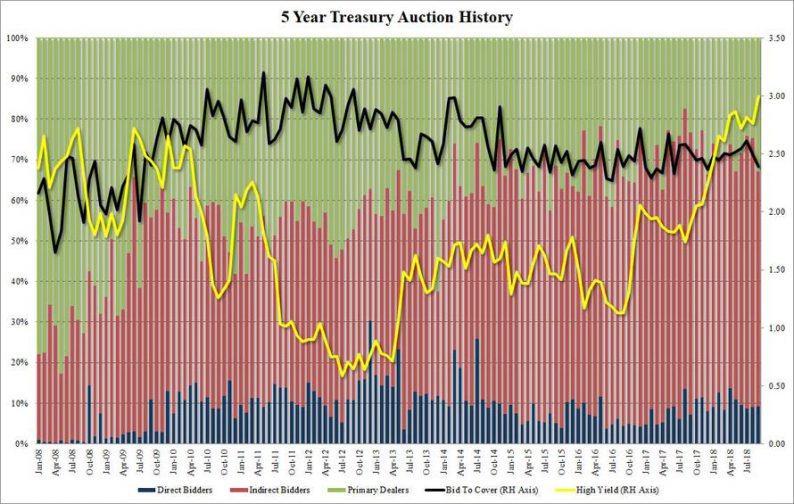

After yesterday’s ugly, tailing 2Y auction, moments ago the Treasury sold $38 billion in 5 Year paper in an auction that was just as forgettable, and perhaps just as weak.

The high yield came in just shy of 3%, or 2.997%, a generous 0.4bps tail to the 2.993% When Issued, the biggest since June; the stop was nearly 24 bps higher than August’s yield of 2.765%, and the highest stop September 2008.

The internals were similarly ugly, with the Bid to Cover sliding to 2.39 from 2.49 last month, below the 2.53 six auction average, and the lowest going back to December 2017. Just like yesterday, Indirect demand slumped, dropping from 66.2% last month to 57.9%, below the 62.6% average, while Directs took down 9.2%, in line with the 9.0% in August, leaving 32.9% to Dealers, the highest since December 2017.

Whether the subdued demand for auctions this week is a function of the Fed’s imminent rate hike, due to a pullback in pension demand or the absence of Chinese and Japanese buyers yesterday (they should be back today), is unclear but the curve tightening along the belly is accelerating, with the 5s10s now just over 10bps and as the curve continues to pancake, the danger is of an all-out flattening, something which the Fed will surely want to avoid.

Leave A Comment