Positive numbers on all measures of the UK retail sales report: 1.3% m/m against 0.5% expected and on top of an upwards revision worth +0.8% for the previous month. Year over year, we have a rise of 4.3%. Excluding fuel, a rise of 1.5% was reported m/m and y/y it is 4.2%. All the figures are accompanied by healthy upwards revisions.

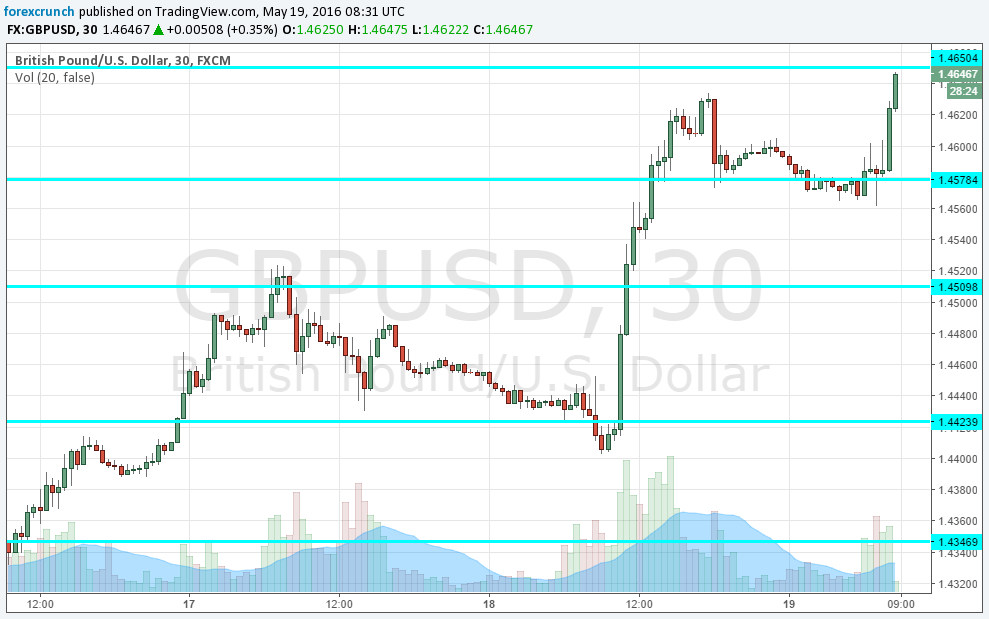

GBP/USD already advanced before the publication and is now slightly extending its gains.

The shift in the Easter holiday from April to March may have had an impact on reporting, triggering the significant revisions.

Here is the GBP/USD 30 minute chart, showing that the lion’s share of the move came before the release rather than after it.

Update: the pound is on a roll, reaching a new high of 1.4662 on GBP/USD and new lows in EUR/GBP.

The UK was expected to report a rise in retail sales in April: 0.5% m/m after a drop of 1.3% in March. Year over year, an advance of 2.5% was predicted after 2.7% seen last time. Excluding fuel, a rise of 0.6% was predicted m/m and 1.9% y/y.

GBP/USD was looking good ahead of the publication, front-running the publication perhaps on rumors / leaks / expectations of a strong number. The pair traded at 1.4620, close to the cycle highs. EUR/GBP dropped to 0.7670.

The pound is moving according to the flutes of opinion polls regarding the EU Referendum. In recent days, the polls have certainly favored the Remain campaign.

Leave A Comment