Under Armour, Inc. (UA – Analyst Report) reported robust results in third quarter 2016. The company reported earnings per share of 29 cents, beating the Zacks Consensus Estimate of 25 cents. Earnings also increased 26.1% year over year.

Aided by continued strong performance of the Apparel, Footwear and Accessories categories, total revenue came in at $1,471.6 million, surging 22.2% year over year and also surpassing the Zacks Consensus Estimate of $1,453 million. Notably, the company has registered more than 20% revenue growth for the 26th consecutive quarter.

The company, which competes with giants such as Adidas and Nike, Inc. (NKE – Analyst Report) in the sports apparel business, is keen on expanding its footprint and enhancing brand recognition to get an edge and the deal with rising athletes provides it a suitable platform to showcase its brands.

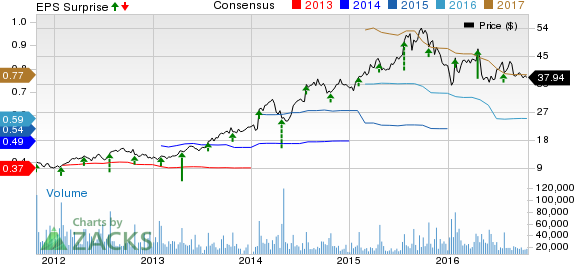

UNDER ARMOUR-A Price, Consensus and EPS Surprise

UNDER ARMOUR-A Price, Consensus and EPS Surprise | UNDER ARMOUR-A Quote

Under Armour’s largest product category, Apparel, once again reported strong sales. Apparel sales jumped 18% to $1,021.2 million buoyed by growth in men’s training, women’s training, golf as well as team sports, while Footwear net revenue soared 42.1% to $278.9 million during the quarter on the back of growth in running and basketball. Net revenue in the Accessories category advanced 17.6% to $121.8 million backed by the bags and headwear category. Licensing revenue rose 21.3% year over year to $29.5 million.

The company’s Connected Fitness segment reported massive year-over-year growth of 39.8% to $20.2 million. This was driven by the acquisitions of Endomondo and MyFitnessPal. These buyouts, along with its existing MapMyFitness and UA RECORD suite of applications, aided the company to form one of the largest digital health and fitness communities.

Under Armour recorded a 19% surge in wholesale net revenue to $1.01 billion and a 29% increase in Direct-to-Consumer net revenue to $408 million. North America net revenue went up 16%, whereas international net revenue, which represented 15% of total net revenue, increased 74% or 80% on a currency neutral basis.

Leave A Comment