Recently a number of commentators on the weekly business shows have commented oil prices and the stock market have been moving in the same direction during the month of January. On the few days oil and stocks moved in opposite directions, the conclusion was this would be a good thing for the overall market. Not wanting to single out any one specific strategist, but this past Monday, Bill Stone, chief investment strategist at PNC Wealth Management, noted on CNBC, “it’s not clear whether the selling will subside for now because of the tight correlation between stocks and oil prices, which he says should break at some point (emphasis added).” This comment is similar to a number of other strategists.

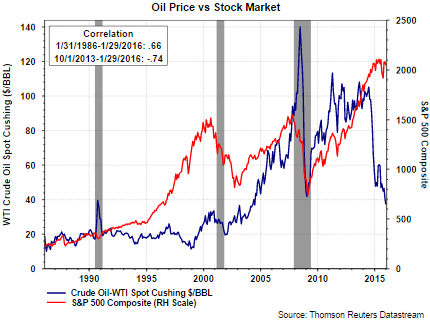

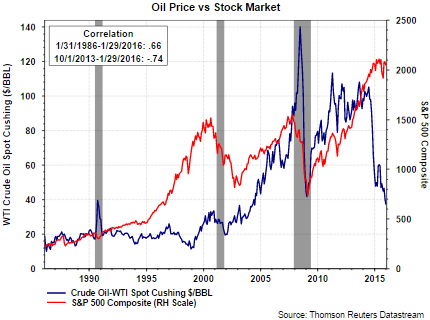

So what is the point then? As the below chart shows, going back to the mid 1980’s the price of oil and the price of stocks have a positive correlation of .66. It only has been since October of 2013 that this correlation broke down and reversed. Since the October 2013 time period, the correlation between oil prices and stock prices has been a negative .74. In other words, market participants should be rooting for higher oil prices and a return to the positive correlation that has been evident over the long run. In all seriousness though, investors should be aware of the fact that there is a high positive correlation between oil and stock price movements.

From The Blog of HORAN Capital Advisors

A number of factors can influence the price of oil, but stronger demand in an environment of stable supply can cause oil prices to rise. This often occurs when stronger economic activity is present. What seems to be occurring today is lower oil prices face downward pressure due to the continued increase in supply in spite of a significant reduction in drilling rig count. The first chart below shows global demand has continued to increase; however, supply growth is greater than the growth in demand. The supply/demand imbalance does not come into balance until late 2016. The second chart shows rig count (maroon line) has declined by more than 60%, i.e., 1,216 rigs, yet supply (green line) has continued to grow.

Leave A Comment