The current slump in global crude oil prices has exacted quite a significant toll on the oil and gas industry. Job losses worldwide are currently in excess of 200,000 and rising, billions of dollars worth of projects have been deferred or cancelled and there have been assets divestment as well as consolidation among companies in the industry.

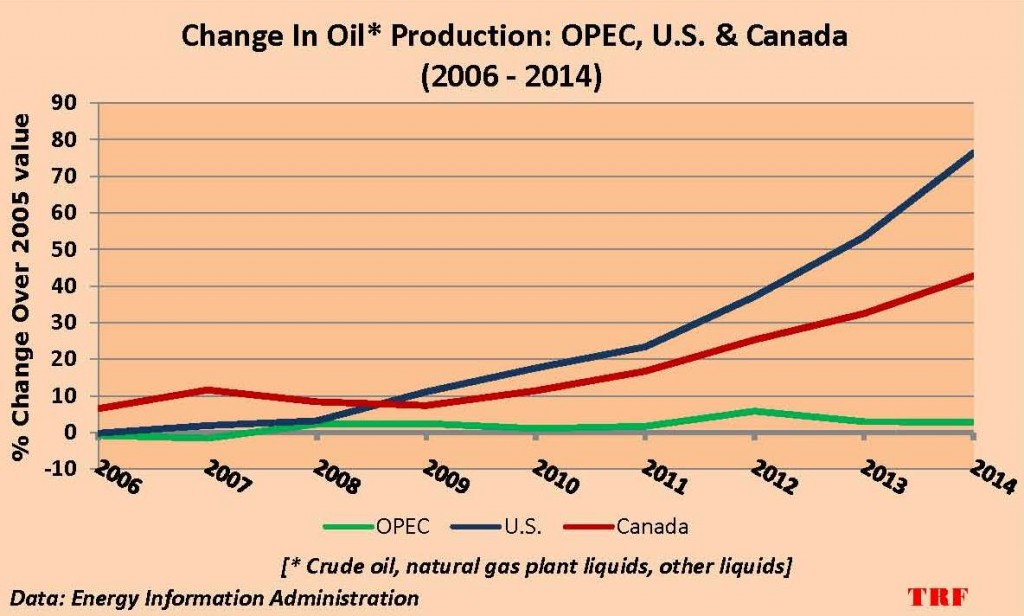

That price slump derives in the main, from weakening demand and rapid increase in supply, with the United States shale oil output accounting for most of that increase. Without a doubt, the decision by Organization of the Petroleum Exporting Countries, OPEC, not to rein in supply, only widened the imbalance ? excess of supply over demand ? and steepened the slump.

Shale oil production in the U.S. rose from about 500,000 barrels per day (bpd) in 2005 to about 4.5 million bpd by the end of last year, or about 52% of that year’s 8.6 million bpd output. The massive ramp-up in shale gas output through hydraulic fracturing (or fracking) also led to the glut in U.S. natural gas supply and ultimately the commodity’s price collapse.

Impairments

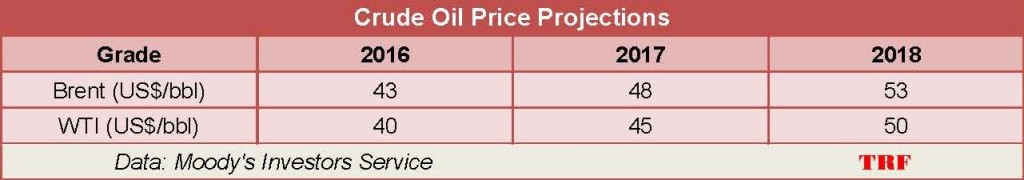

The shale boom or shale revolution ? as that steep supply growth has come to be known ? was financed largely through heavy borrowing and in many cases, cash outflows substantially exceeded inflows. Loans were obtained against the values of proven reserves and most of those valuations were made when oil prices were close to US$100 per barrel; with oil prices currently less than US$40 per barrel, and projected to be little-changed in the near term, corporate assets may suffer critical impairments. The imminent rate hike by the United States Federal Reserve may even exacerbate the distress.

According to Bloomberg, companies such as Chesapeake Energy Corp. (CHK) (45%), Bill Barrett Corp. (BBG) (40%) and Oasis Petroleum Inc. (OAS) (33%) stand to suffer substantial assets impairment. Many of the Wall Street firms that financed the shale boom have already been severely impacted.

Leave A Comment