Unemployment is set to increase very soon.

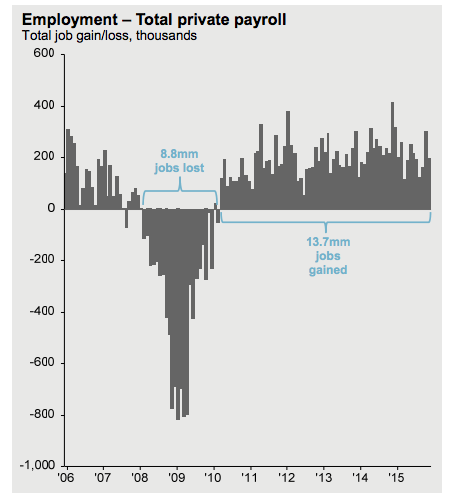

Although the recovery in jobs has been stronger than most realize or are willing to accept, it’s about to reverse. Rising unemployment is coming (and so might a recession).

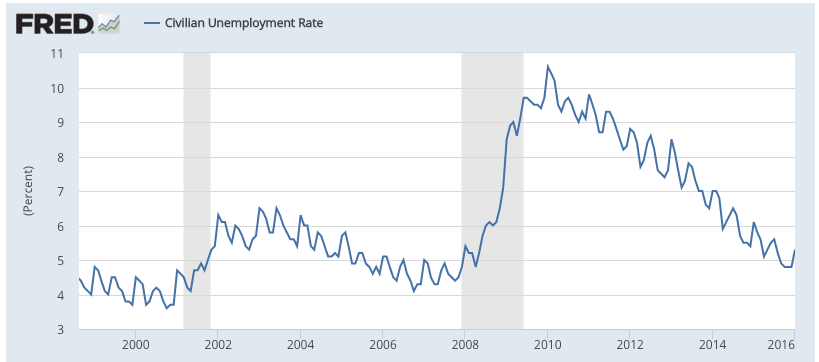

The employment situation has been better than most realize or are willing to accept. According to the unemployment numbers, we’ve seen slow but steady growth in jobs. The Unemployment Rate is much lower than it was in 2008 and 2009, at the height of the Great Recession.

Source: FRED

Source: JP Morgan

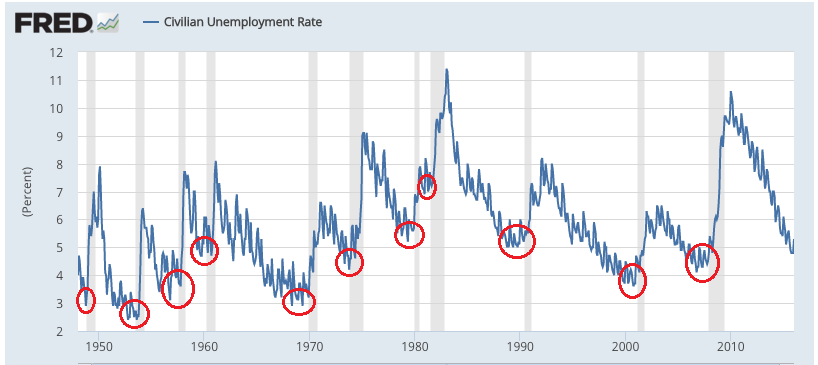

Unfortunately as it relates to Unemployment, it always looks brightest right before it turns for the worse. When unemployment it at or near decade-lows, it tricks us into thinking that the economy is certainly doing well. The economy does in fact grow and improve as the Unemployment Rate falls. However, the closer we get to the “turning point” or decade-low, the higher the probability that economic growth is about to reverse course.

In other words, Unemployment has dropped so much that this could be the best we’ll see. 5% Unemployment is not bad! We should be happy that the US figured out how to keep unemployment low. But, if Unemployment is about to rise, that likely also means that economic growth is slowing.

If you look at the long-term chart of Unemployment Rate, you can see that a significant multi-year (even multi-decade) bottom in the Unemployment Rate preceded almost every single Recession since 1948 (Recessions shaded grey):

Another signal pointing to higher Unemployment is the major difference between the “Seasonally-adjusted” and “non-Seasonally-adjusted” Unemployment Rate numbers.

The government agencies like to “seasonally-adjust” official numbers in order to “smooth” out results and/or remove unjustified deviations due to catastrophes, one-time events, or season-related trends. This results in much smoother, less volatile results over time – as can be seen in the long-term Unemployment Rate charts.

Non-Seasonally-Adjusted:

Leave A Comment