Friday morning’s jobs report is a fairly important news event – – – one on the calendar, at least, as opposed to these (ultimately meaningless) missile attack threats from the lunatics in North Korea. I’ll be watching the ES most carefully. It has been in a range for a while, and after it broke out, its ultimate peak was precisely the measured move (see green tints). Suffice it to say, it would be mad for me if we pushed to new lifetime highs.

Oddly, having gone through my 40 SlopeCharts indexes, the most appealing one is from Amsterdam, of all places. Just sayin’.

But let’s deal with something closer to home: I have taken a special interest in the US dollar, which has been grinding down quite consistently for the entirety of 2017. After the latest missile scare disappeared, it recovered somewhat, but I think the downtrend is firmly in place. If it continues, my gold miners long (that is, NUGT, should do well). Here’s what the dollar looks like from late 2016 to present:

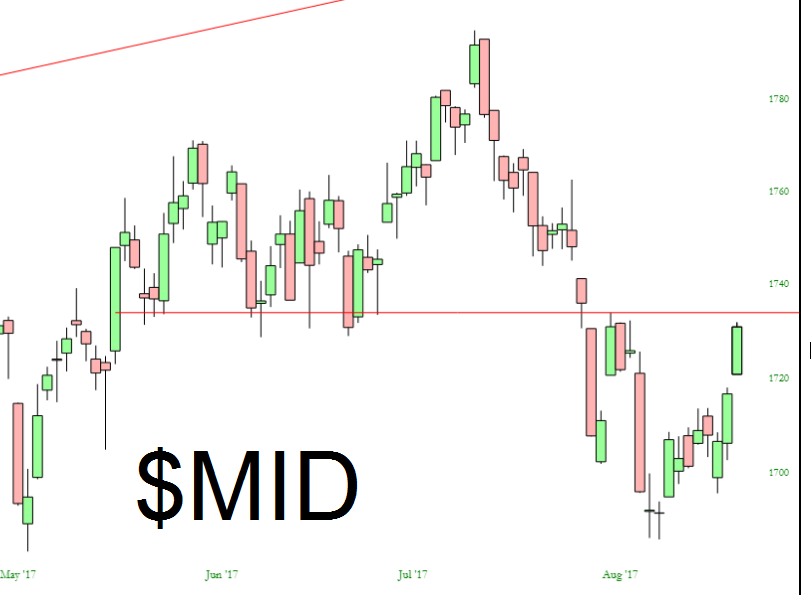

Some indexes are stronger than others these days. The Nasdaq, for instance, is at lifetime highs, threatening to slip into 5000+ territory (umm, kind of like bitcoin). The MidCaps are more my speed, as they approaching a fairly important gap and a decent amount of overhead supply.

Much the same can be said for the Russell 2000 small caps, with a similar overhead supply situation (green tint).

Currently, I’m only “medium aggressive” in my positioning. The past couple of days have been somewhat rough, and whether or not we can continue to bang out lowers lows and lower highs is very much in the balance once again. By Friday’s end, I think we’ll have a lot more clarity as we enter the ostensibly-bearish month of September.

Leave A Comment