The past few days have had a high intensity of news flow as the stock market had a mini melt down and earnings season kicked into high gear. Therefore, some of my analysis has been delayed by a few days. I am now going to review the jobs report which came out on Friday.

Solid Headline & Acceleration In Hourly Earnings Growth

As I expected based on the low jobless claims and the solid ADP report, the BLS non-farm jobs report for January was good again. It showed 200,000 jobs created which beat estimates for 180,000 jobs created. On the negative side, the 2 previous months’ revisions had a net change of -24,000 jobs. The unemployment rate stayed at 4.1% for the 4th straight month. As you know, the year over year change in the unemployment rate is a critical indicator I review. The unemployment rate in January 2017 was 4.8%. We’re still far from seeing a negative rate of change, but I expect that to be hit in late 2018 or early 2019. In the midst of the panicking on Wall Street, it’s important to review how far out the cycle is from a recession. We may be in the late stages of the bull market, but it probably has 1-2 years left.

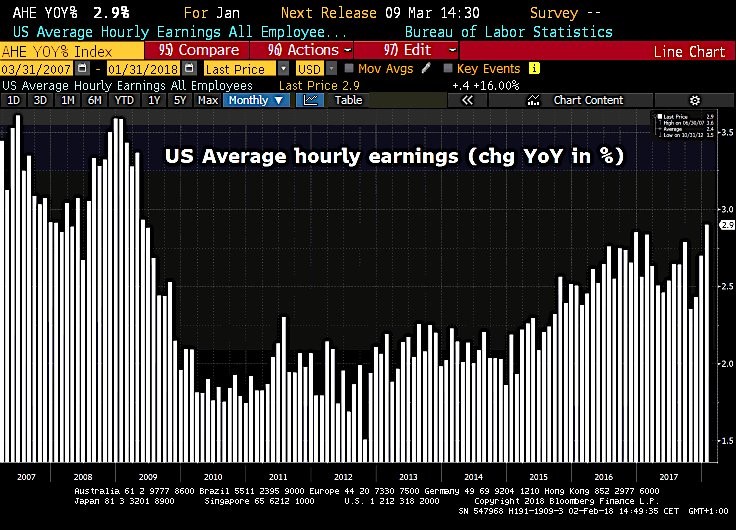

The most discussed figure in the jobs report was hourly wage growth. It showed 2.9% growth which beat estimates for 2.6% growth. The actual wages went from $25.99 an hour to $26.74. Growth was 0.3% month over month which beat expectations by 0.1%. As you can see in the chart below, the growth rate was the highest since June 2009. Some traders on Wall Street joked that this improvement caused the stock market decline on Friday and Monday because it caused inflation estimates to increase.

The reason why this joke is ridiculous is that the hourly wage growth is meaningless without improvements to the length of the work week. The only thing that matters to the economy is take home pay, not the time it took to earn the money. The work week shrunk from 34.5 hours to 34.3 hours which means the hourly earnings growth didn’t translate into an acceleration in take home pay growth.

Leave A Comment