The people in Pepsi’s marketing and PR departments must be relieved, because the internet’s viral outrage is finally being channeled in a different direction.

This time the fury is targeted towards United Airlines (UAL)– a brand that is in full-blown crisis mode after a bloodied passenger was forcibly dragged off a plane, and millions of people witnessed videos of the incident being spread over social media.

Two days into the crisis, here are some charts that will help give context around what happened, as well as the potential effect on the United brand itself.

DAMAGE DONE?

First, let’s take a look at what’s happened to United’s stock price since the incident:

While some public relations crises have minimal effects on the long-term financial performance of companies, this market reaction is an interesting gauge to consider.

The stock’s lowest point today was -4.3% below the open, which is equal to a nearly $1 billion loss in market capitalization. At that point, it was speculated that Warren Buffett’s Berkshire Hathaway (BRK-A, BRK-B), which owns 9% of all outstanding shares of United Continental Holdings Inc., could lose up to $87 million.

The market clearly saw the crisis as creating risk around United’s fundamental business, but the stock has mostly recovered since those intraday lows. That said, if there are reports of top line revenue being affected because of boycotts or other issues, then the incident’s impact on the stock price could easily re-surface.

SOCIAL MEDIA BLOWBACK

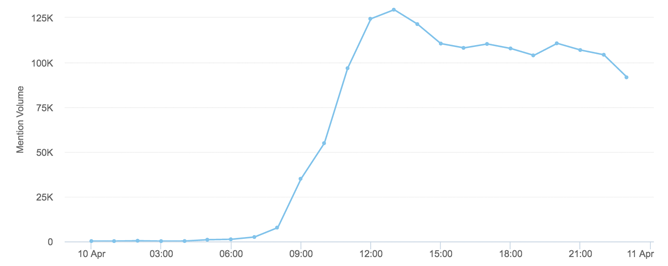

With today’s interconnected world, a public relations crisis can start with one tweet. Here’s the snowball effect in brand mentions of United that occurred on April 10th:

Courtesy of: Brandwatch

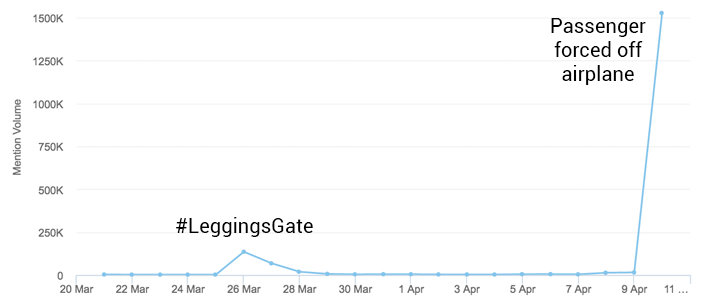

Here’s another look. This time, it’s a comparison of mentions over the last 21 days.

Courtesy of: Brandwatch

Yes, it’s only been about two weeks since United’s last PR crisis, called #LeggingsGate. As you can see, however, the most recent disaster is many times worse in terms of mentions.

Leave A Comment