Urban Outfitters (URBN – Analyst Report) announced financial results for the first quarter of fiscal 2017, posting earnings of $0.25 per share and net sales of $762.6 million.

Currently, Urban Outfitters has a Zacks Rank #3 (Hold), but it is subject to change following the release of the company’s latest earnings report. Here are 5 key statistics from this just announced report below.

Urban Outfitters:

1. Met earnings estimates: The company posted $0.25 per share, matching our Zacks Consensus Estimate of the same value.

2. Beat revenue estimates: The company saw revenue figures of $762.6 million, narrowly beating our estimate of $760.4 million.

3. The company’s total inventory decreased by $38 million, or 10%, on a year-over-year basis. The decrease in total inventory is primarily related to the decline in comparable Retail segment inventory, which decreased 10% at cost.

4. “We are pleased to announce record first quarter sales and improved gross profit margins,” said Richard A. Hayne, Chief Executive Officer.“These results were driven by more compelling product assortments, improved inventory management and stronger marketing,” finished Mr. Hayne.

5. Shares of URBN are up 9.80% during after-hours trading as of 4:29 PM ET.

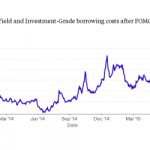

Here’s a graph of Urban Outfitters percentage change over 3 months versus its competitors:

Urban Outfitters Inc. (URBN – Analyst Report) vs. Peers Percent Change Over Time – 3 Months | FindTheCompany

Urban Outfitters, Inc. operates two business segments consisting of a lifestyle-oriented general merchandise retailing segment and a wholesale apparel business. The retailing segment operates through retail stores and direct response, including a catalog and two web sites. The company’s wholesale business designs and markets young women’s casual wear which it provides to the company’s retail operations and sells to specialty retailers worldwide.

Leave A Comment