EUR/USD almost broke 1.13 lows as the focus now shifts on the ECB decision later this week. From a market perspective, the meeting should not provide further clarity but is likely to be seen as an early indication of what we can expect in the December ECB meeting. A change in rates is out of the table however, it is almost certain that the ECB will increase its QE program in an effort to revive the economy.

While USD is strong, GOLD is also under pressure with the metal hitting a $1170.70 low. This is the third straight session that GOLD is dropping. It is pretty clear that the inverse relation between gold and dollar has become stronger over recent weeks.

Looking ahead, it’s an important week in Canada with federal elections, BoC rate decision and release of retail sales and CPI. Don’t forget the ECB meeting on Thursday.

Green lines are resistance, Red lines are support

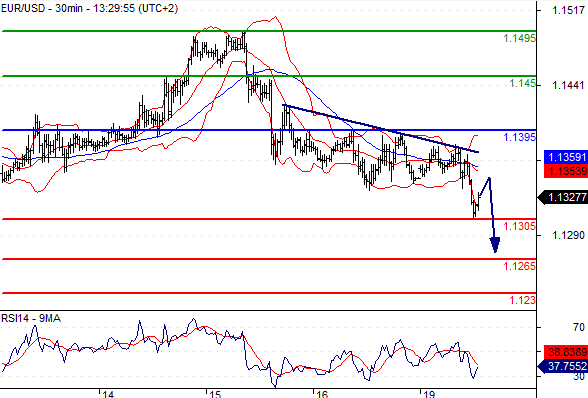

EUR/USD

Pivot: 1.1395

Likely scenario: Short positions below 1.1395 with targets @ 1.1305 & 1.1265 in extension.

Alternative scenario: Above 1.1395 look for further upside with 1.145 & 1.1495 as targets.

Comment: The pair is capped by a declining trend line.

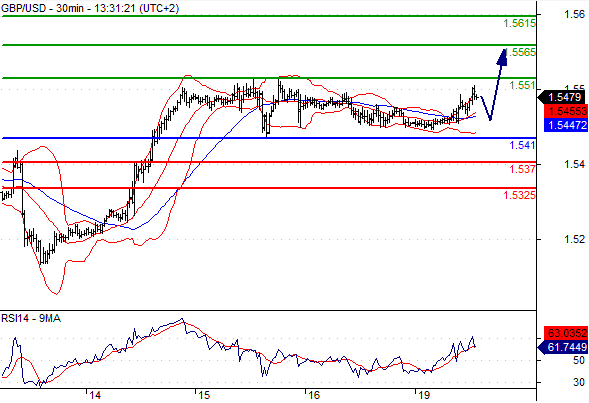

GBP/USD

Pivot: 1.541

Likely scenario: Long positions above 1.541 with targets @ 1.551 & 1.5565 in extension.

Alternative scenario: Below 1.541 look for further downside with 1.537 & 1.5325 as targets.

Comment: The RSI is well directed.

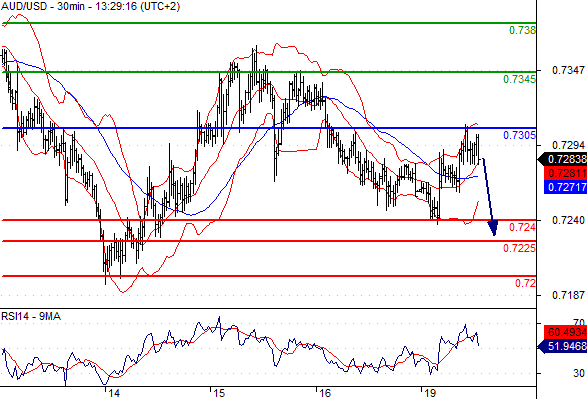

AUD/USD

Pivot: 0.7305

Likely scenario: Short positions below 0.7305 with targets @ 0.724 & 0.7225 in extension.

Alternative scenario: Above 0.7305 look for further upside with 0.7345 & 0.738 as targets.

Comment: As long as the resistance at 0.7305 is not surpassed, the risk of the break below 0.724 remains high.

USD/JPY

Pivot: 118.9

Likely scenario: Long positions above 118.9 with targets @ 119.65 & 119.9 in extension.

Alternative scenario: Below 118.9 look for further downside with 118.6 & 118.05 as targets.

Comment: The RSI is well directed.

Leave A Comment