Recent economic reports suggest that the US economy will continue to grow at a modest pace. Although macro risk has increased in recent months, the probability is low that a recession started last month and the near-term outlook suggests that the economy will continue to sidestep a new downturn, based on current data.

The bigger risk at the moment is sluggish growth, which raises the potential for trouble later this year. The Atlanta Fed’s latest first-quarter estimate for US GDP growth highlights the hazard via yesterday’s update, which reaffirmed the outlook for a soft 1.9% rise in Q1 output (Mar. 16 estimate). Although that’s up from a 1.0% increase in last year’s Q4, the latest numbers reflect a relatively slow expansion.

The Federal Reserve recognized the potential for weak growth by downsizing expectations for interest-rate hikes at yesterday’s policy update. “You have seen a shift this time, in most participants assessments of the appropriate path for policy,” Fed Chair Janet Yellen explained. “That largely reflects a somewhat slower projected path for global growth, for growth in the global economy outside the United States, and for some tightening in credit conditions in the form of an increase in spreads.”

For now, the odds are still low that a new recession has started, based on the published numbers to date through last month. Near-term projections through April anticipate that the broad trend will remain positive, albeit at diminished levels relative to strongest rates in 2015. The analysis is basedon a methodology outlined in

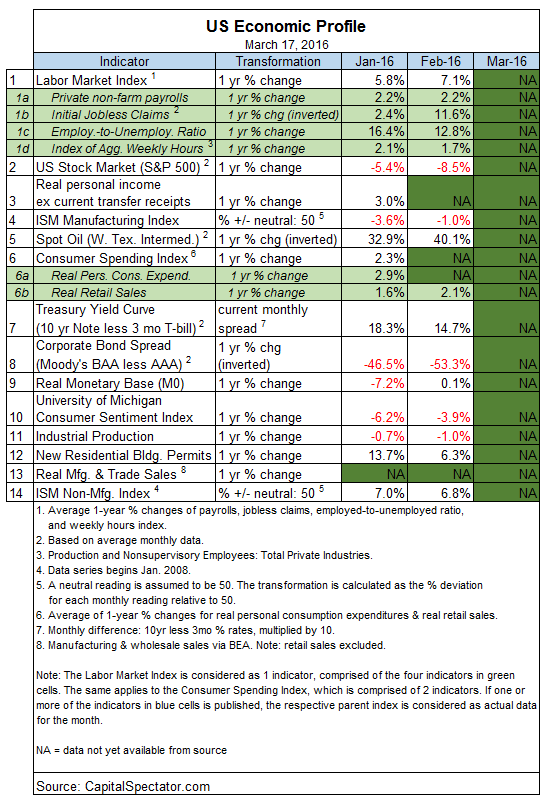

. The Economic Trend and Momentum indices (ETI and EMI, respectively) have fallen in recent months but remain at levels that equate with expansion. Here’s a summary of recent activity for the components in ETI and EMI:

Aggregating the current data in the table above into business cycle indexes reflects weaker but still positive trends overall. The latest numbers for ETI and EMI show that both benchmarks are above their respective danger zones: 50% for ETI and 0% for EMI. Yet it’s also clear that both indexes have stumbled in recent months. When/if the indexes fall below the tipping points, we’ll have clear warning signs that recession risk is at a critical level. Meantime, the latest updates for February show that ETI is just below 60% and EMI is at 1.5%. Both numbers reflect another dip from the previous month, but there’s still a margin of safety, albeit a relatively narrow one between current values and the danger zones, as shown in the chart below. (See note at the end of this post for ETI/EMI design rules.)

Leave A Comment