The manufacturing sector may be in recession, but the labor market still looks resilient. That’s the key message in recent economic updates. It’s anyone’s guess if this skewed relationship will endure, but for the moment it’s enough to keep the threat of recession in the category of a low-probability event, based on numbers published to date. With so much riding on payrolls these days, a stumble in job growth right about now would be a problem. But that’s not a real and present danger, according to yesterday’s weekly update on new filings for unemployment benefits.

Initial jobless claims fell last week, pulling back from a five-month high and settling at a seasonally adjusted 271,000. “Claims are staying at historically very low levels, which shows the labor market is pretty tight,” David Berson, chief economist at Nationwide Insurance, tells Bloomberg. “For the bulk of the economy, demand for workers is reasonably high. Companies are hesitant to let workers go.”

The upbeat news on claims pared the recent spike in the Philly Fed’s business cycle benchmark—the ADS Index. The implied probability of a new US recession from the vantage of this metric eased to low 11%, based on economic data for the period through Dec. 12.

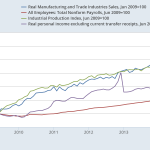

Economic risk is also low as of last month, according to The Capital Spectator’s Economic Trend and Momentum indices (ETI and EMI, respectively), which track a diversified set of indicators. Near-term projections through January anticipate a slower macro trend, but at levels that remain well above the danger zone. The analysis is based on a methodology outlined in Nowcasting The Business Cycle: A Practical Guide For Spotting Business Cycle Peaks. Using this framework, an aggregate of economic and financial trend behavior shows that business-cycle risk remained low through November. The current profile of published indicators through last month (12 of 14 data sets) for ETI and EMI continue to signal a positive trend overall. The three exceptions in November: the corporate bond spread, the ISM Manufacturing Index, and industrial production. Otherwise, positive trending behavior rolls on.

Leave A Comment