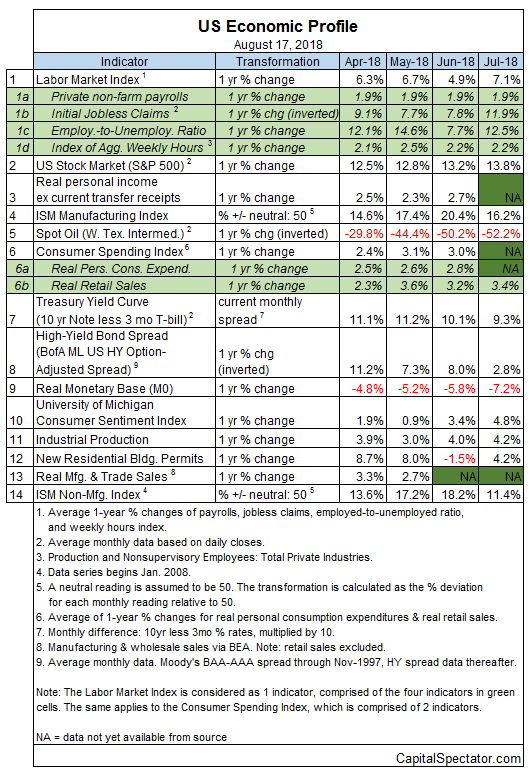

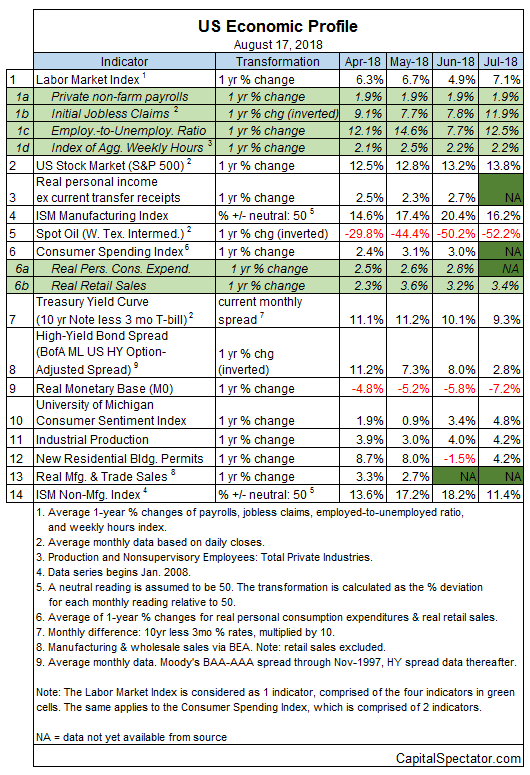

Geopolitical risk is rising, but if there’s a price to pay in terms of sharply softer economic growth or worse for the US it’s not showing up in the numbers, at least not yet. With most of the July data published the macro profile remains upbeat and near-term projections suggest the positive trend will persist.

Several risk factors bubbling on the world stage (a trade dispute with China and a financial crisis in Turkey, for example) could upend the rosy outlook – or not. But using the figures published to date continues to paint an encouraging macro picture for the US.

On the GDP front for the third quarter, several nowcasts point to another round of solid growth. Note, however, that some models reflect a deceleration in expected output, albeit following a strong 4.1% increase in Q2 (seasonally adjusted annual rate). Today’s revised Q3 estimate via Now-casting.com, for instance, calls for a slowdown to 3.2% — down from 4.0% in late-July. The current projection still marks a solid gain, but it’s early in the quarter and so there’s plenty of uncertainty about how the estimates for the current quarter will evolve — uncertainty that’s magnified due to concerns about a trade war and a possibility of escalating headwinds for emerging markets.

To be fair, other models see growth accelerating for the US. Yesterday’s update of the Atlanta Fed’s GDPNow model points to a 4.3% advance in economic activity for Q3.

Whatever’s in store for Q3 and beyond, this much is clear: US economic activity has been healthy to date. The Capital Spectator continues to estimate a virtually nil probability that a new NBER-defined downturn started in July, based on a diversified set of economic indicators. (For a more comprehensive review of the macro trend with weekly updates, see The US Business Cycle Risk Report.)

Aggregating the data in the table above continues to indicate a strong positive trend overall. The Economic Trend and Momentum indices (ETI and EMI, respectively) remain well above their respective danger zones (50% for ETI and 0% for EMI). When/if the indexes fall below those tipping points, the declines will mark overt warning signs that recession risk is elevated and a new downturn is imminent. The analysis is based on a methodology that’s profiled in my book on monitoring the business cycle.

Leave A Comment