The US economic trend remains solidly positive, but signs of slowing growth persist. For now, the risk of recession remains virtually nil and it’s unlikely that a downturn will start in the immediate future, according to broad set of indicators. But projections for next year, which remain highly speculative at this point, suggest that recession risk will rise – a forecast that deserves close attention as new data arrives in the weeks ahead.

Keep in mind that looking beyond two or three months for business-cycle analysis is a dicey affair and so at this stage it’s wise not to take the warning signs for 2019 too seriously. A lot can change between now and next April, when projections point to a possibility that a new downturn could start. It’s short-sighted to ignore this potential turning point for the business cycle, but for now it’s prudent to consider this a distant threat that may or may not arrive.

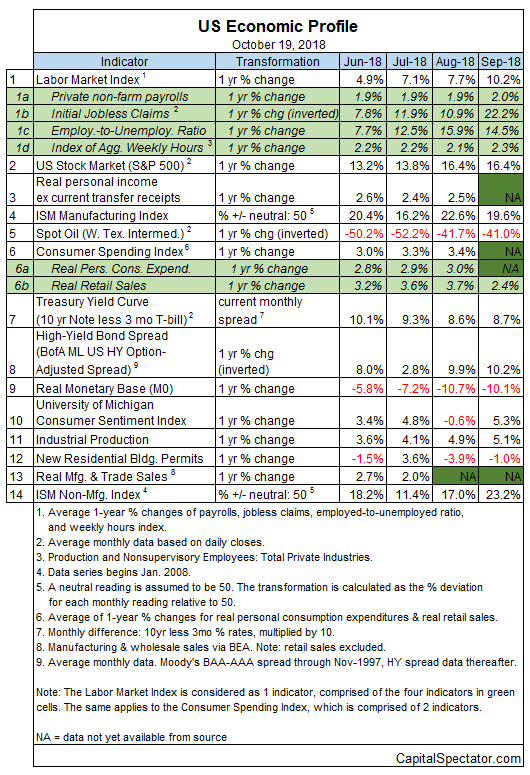

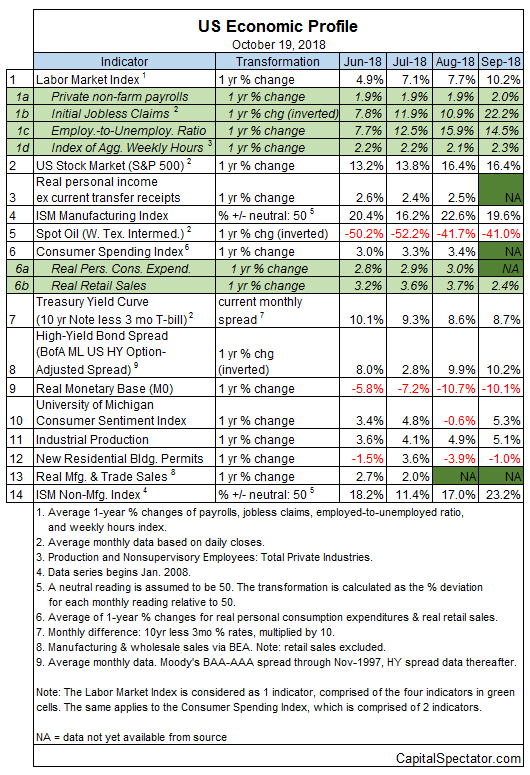

Meantime, the macro profile for the US remains healthy, based on data published to date. Although the strength of the broad trend has decelerated in recent months, the current reading still aligns with a solid expansion and low recession risk.

The Capital Spectator continues to estimate a virtually nil probability that a new NBER-defined downturn started in September, according to analysis of a diversified set of economic indicators. (For a more comprehensive review of the macro trend with weekly updates, see The US Business Cycle Risk Report.)

Aggregating the data in the table above continues to indicate a strong positive trend overall through last month. The Economic Trend and Momentum indices (ETI and EMI, respectively) remain well above their respective danger zones (50% for ETI and 0% for EMI). When/if the indexes fall below those tipping points, the declines will mark warning signs that recession risk is elevated and a new downturn has started or is near. The analysis is based on a methodology that’s profiled in my book on monitoring the business cycle.

Leave A Comment