The recent run of soft economic data inspires some pundits to claim that a new recession is brewing. They could be right, but they could just as easily be wrong. Although some numbers published to date have been weaker than expected, a broad profile of economic activity still reflects low recession risk. Near-term projections tell a similar story. From a probability standpoint, betting that a recession has started or is about to start still stacks up as a long shot.

Economic risk could change with the next batch of data, of course, but using the numbers available today strongly implies that the odds are low that an NBER-defined recession is underway, based on reports published through July 18.

Upcoming big-picture data is on track to confirm this analysis. Next week’s preliminary estimate of GDP growth for the second quarter via the Bureau of Economic Analysis is widely expected to show that output accelerated after Q1’s weak 1.4% increase. As I discussed yesterday, Q2 forecasts have been trimmed in recent weeks and most projections now reflect moderate growth of roughly 2%-3% (seasonally adjusted annual rate). But that’s still a respectable pace compared with the average 2% advance in quarterly GDP changes over the past five years.

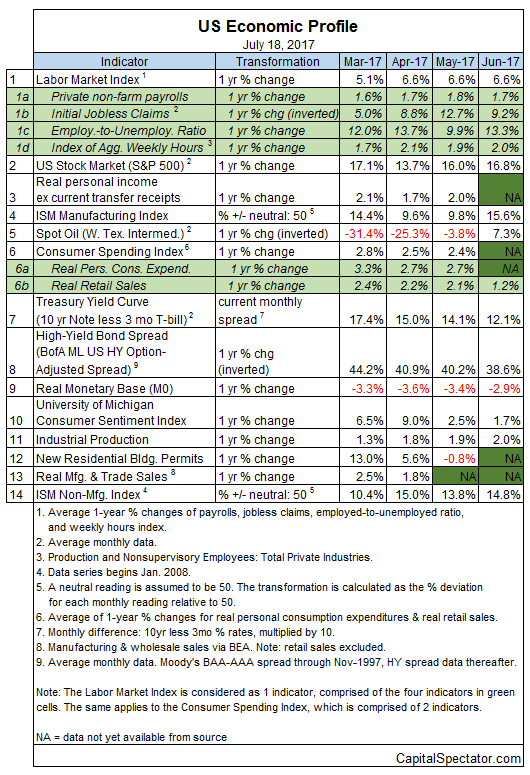

As for recession risk, the probability remains virtually nil that a downturn has started, based on numbers published to date via the Capital Spectator’s proprietary business-cycle indexes. With the first round of data for the June macro profile nearly complete, most indicators continue to reflect a positive trend. As a result, recent reports suggest that there’s enough forward momentum to keep the economy expanding in the immediate future. (For a more comprehensive review of the macro trend on a weekly basis, see The US Business Cycle Risk Report.)

Aggregating the data in the table above continues to a reflect a positive broad trend. The Economic Trend and Momentum indices (ETI and EMI, respectively) have dipped lately, but remain well above their respective danger zones: 50% for ETI and 0% for EMI. When/if the indexes fall below those tipping points, we’ll have clear warning signs that recession risk is elevated and a new downturn is likely. The analysis is based on a methodology that’s profile in my book on monitoring the business cycle.

Leave A Comment