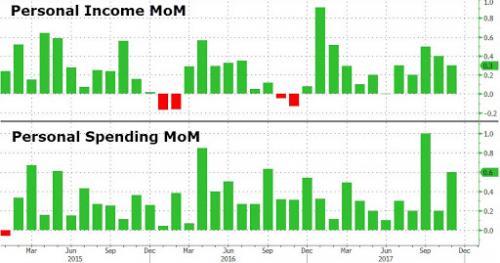

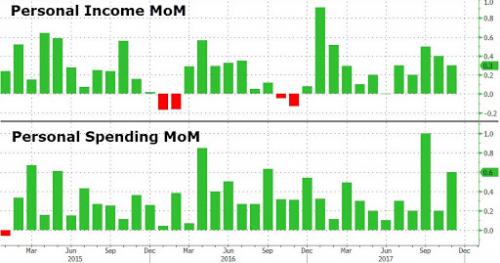

The latest confirmation that the US consumer is now effectively tapped out came early Friday when the Dept. of Commerce reported that in November, Personal Income rose by a lower than expected 0.3% (exp. 0.4%), while US consumers continued to splurge at an accelerated rate, with personal spending rising 0.6%, above the 0.5% expected, as Americans decided to splurge on holiday products and services.

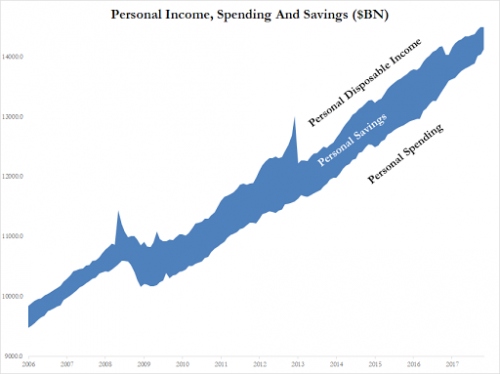

A way of visualizing the historical change in income, spending – and savings – is the next chart below.

However, and speaking of savings, therein lies the rub, because as Americans splurged in November – and much of 2017 – the personal savings rate continued to decline, and in the latest month it tumbled from 3.2% to 2.9%, the lowest since November 2007, which as a reminder was one month before the recession started.

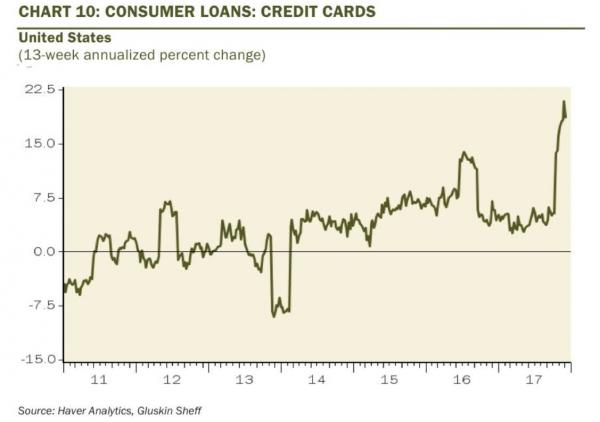

This incidentally explains the surge in credit card usage we noted last night. As a reminder, the 13-week annualized credit card balances in the U.S. have gone completely vertical in the last few months of 2017, a troubling sign and yet another confirmation that US household savings are almost gone, forcing Americans to resort to savings.

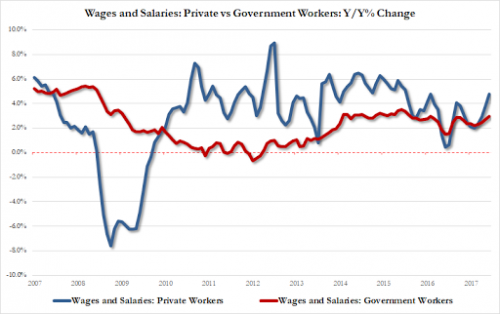

What is somewhat strange is that this collapse in savings took place even as U.S. wage growth actually surprised to the upside, with wage growth rising at 4.5% Y/Y (private rose 4.8%, government 3.0%), more than core consumer spending (4.3%) for the first time since December 2015.

And yet, despite this favorable wage background, Americans were not only unable to save but saw collective savings decline by $41 billion in November to $426 billion.

At this rate the Fed will have to step in and bailout the plunge in bitcoin or else risk a complete collapse in holiday spending.

Leave A Comment