Some analysts speculated if the Fed would try to keep rates low to support the government’s spending binge. However, instead of worrying about the debt, the $400 billion spending plan and the tax cuts are being used as an excuse to raise interest rates and let the government bonds on the Fed’s balance sheet expire.

At a conference on February 27th, which was right after Powell’s first Congressional testimony, Yellen and Bernanke were asked about the biggest risk factor facing the economy. Bernanke said geopolitical events and Yellen worries about how the Fed balances growth versus inflation. While these are risks, it’s amazing to see how many of the mainstream economists ignore the debt bomb facing America. Many Fed critics predict the Fed will go through with some sort of extremely dovish policy to solve the debt problem. However, the Fed isn’t focused on this issue, so it may be behind the curve in coming up with a solution.

From an objective perspective, it appears that whenever the majority party in government increases deficits, the minority party exclaims how bad it is. Then when the parties in charge switch, the same situation arises. Politicians who aren’t in charge complain about the waste and how the government is fiscally irresponsible, but when they become in charge they don’t change anything. The Tea Party movement in 2010 was founded on stopping deficits, but now that the Republicans are in charge, deficits are exploding higher.

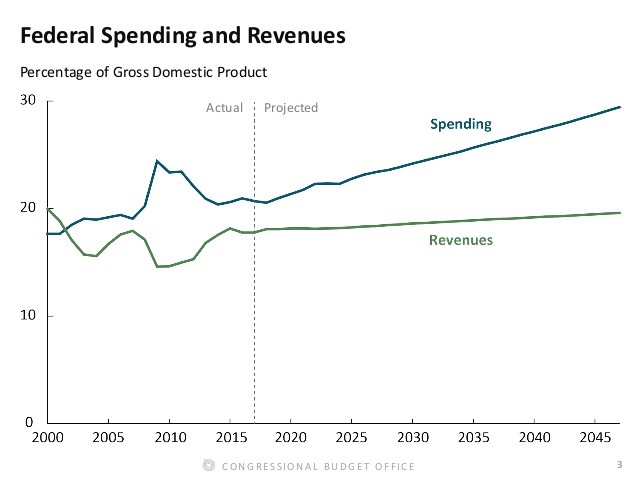

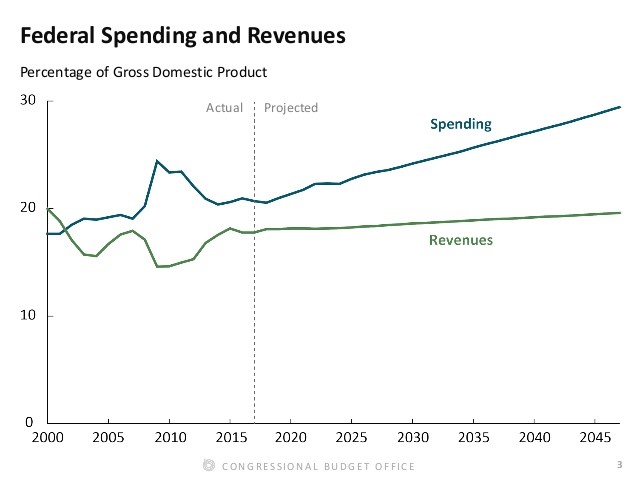

The chart below shows the Congressional Budget Office’s projections for spending and revenues.

Government Spending Is Set To Explode

The debt held by the public is expected to eventually get to 150% of GDP in 2047 and break WWII-era records in less than 20 years. This estimate could be optimistic because the CBO assumes the economy will remain at full employment. However, there will likely be a few recessions in the next few decades which cause the revenues to decrease and the spending to increase, thus making the situation even more dire.

Leave A Comment