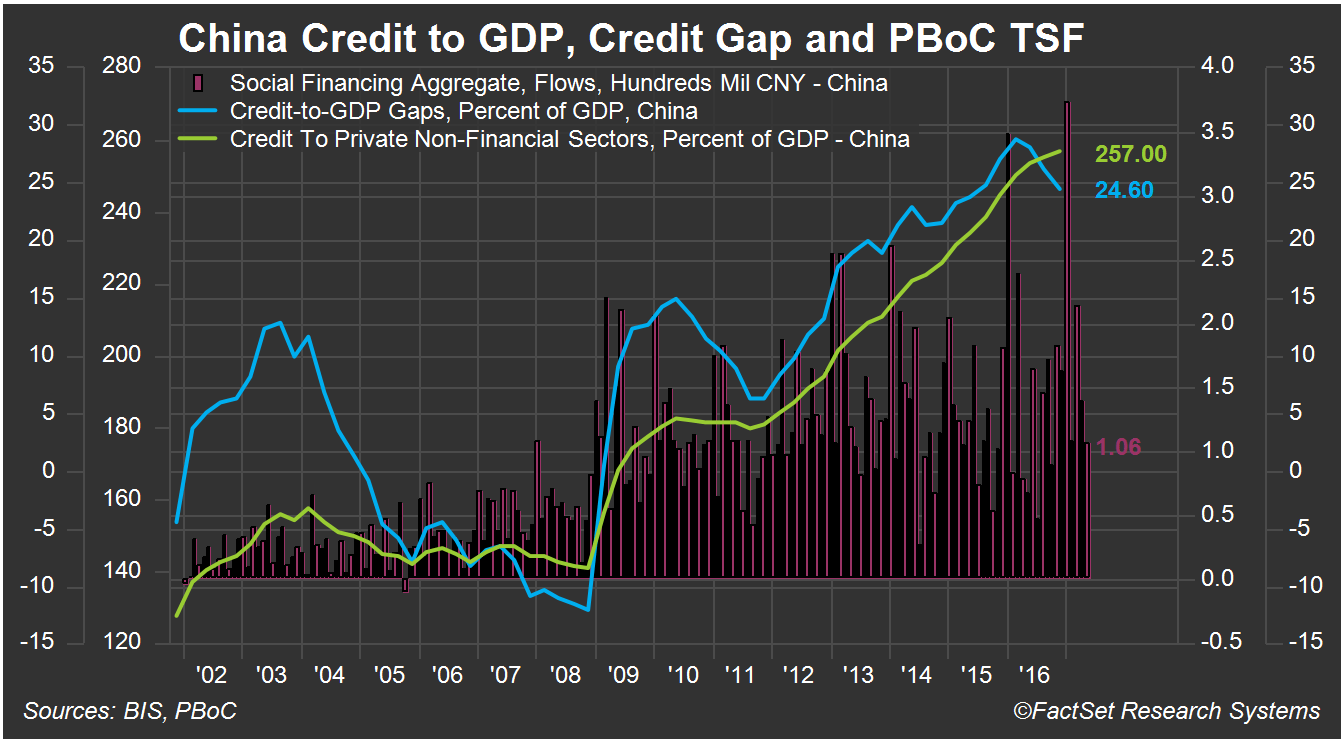

China’s rapidly growing corporate and personal debt is always cited as being one of the main risks to the global economy. The country’s debt mountain has exploded higher since the financial crisis, and after the World Economic Forum had warned that China’s debt would increase by a worrying $20 trillion by 2020 and could soon catch up to the US Debt To GDP levels.

It seems policymakers took it upon themselves to make sure this target was not only met but also exceeded. By 2016 debt had increased to $22 trillion and the current rates it will hit $50 trillion by 2020. In the first quarter of 2017 , China added debt equal to more than 40% of GDP. Policymakers are taking actions to slow leverage growth, clamping down on excessive lending among corporates and trying to rein in shadow banking.

According to Reuters, data published today shows that some of these actions are starting to bear fruit. According to Reuters calculations, combined trust loans, entrusted loans, and undiscounted banker’s acceptances, which are common forms of shadow banking activity, dipped to 428.8 billion yuan in the second quarter from 2.05 trillion yuan in the first quarter.

Meanwhile, broad M2 money supply, which includes demand deposits and monies held in easily accessible accounts, grew 9.4% in June from a year earlier, slowing from 9.6% in May. Still, while there is some progress, it seems overall debt continues to grow. Chinese banks extended 1.54 trillion yuan ($226.9 billion) in net new yuan loans in June, well above analysts’ expectations of 1.2 trillion yuan.

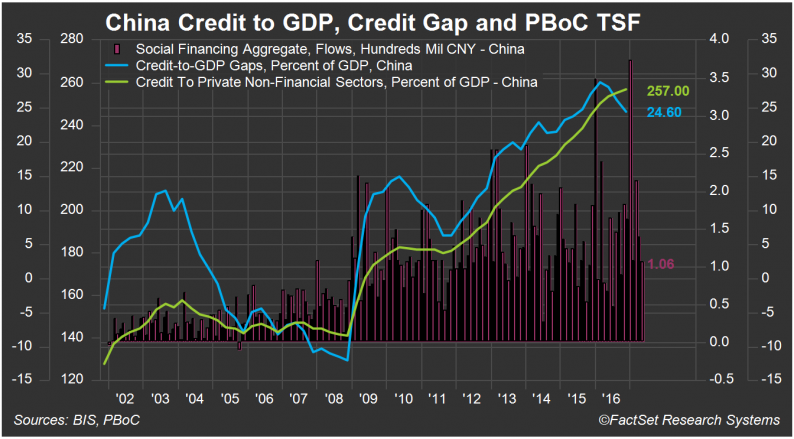

US Debt To GDPA Record will China catch up?

However, it’s not just China that’s building a worrying level of debt. According to a June 29 report from Moody’s “leverage of the US nonfinancial sector has reached unprecedented heights according to the US’s never before seen ratio of nonfinancial-sector debt to GDP.” The report notes that the ratio of US nonfinancial-sector debt to GDP was 253% at the end of the second quarter “considerably higher than year-end 2007’s 230% that immediately preceded the Great Recession.”

Leave A Comment