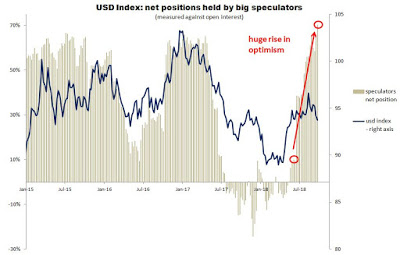

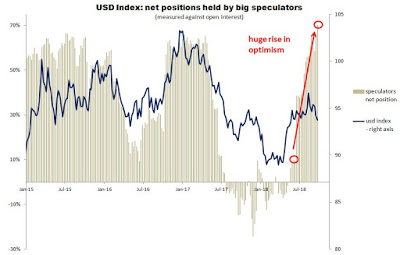

According to the COT data, since May 29 the big speculators betting on a stronger dollar have increased their bullish bets by 13.0 thousand contracts. Over that period the bears (big speculators betting on a weaker dollar) cut their bets by 21.4 thousand contracts.

As a result, a net long position held by these traders went up by 34.4 thousand contracts but…the US dollar index has not changed at all (94.8 on May 29 compared to 94.7 on September 28):

source: Simple Digressions

What is the takeaway for speculators? Well, in my opinion, if something cannot go up pushed by hordes of optimists, it is supposed to go down.

Summarizing – I am bearish on the US dollar in the medium term.

Leave A Comment