The US dollar is sometimes called the world’s “reserve currency,” which is true enough, but doesn’t actually capture the multiple ways in which firms and nations around the world make use of the US dollar. Moreover, these other issues can complicate how other nations are affected by changes in the foreign exchange value of the US dollar. Fernando Eguren Martin, Mayukh Mukhopadhyay, and Carlos van Hombeeck lay out these issues in “The global role of the US dollar and its consequences,” published in the Bank of England Quarterly Bulletin (2017, Q4).

Movements in the foreign exchange value of the US dollar, of course, affect US imports and exports: specifically, a stronger US dollar tends to boost imports (a stronger US dollar buys relatively more) and to weaken exports (a stronger US dollar pushes up relative costs of US producers). But changes in US dollar exchange rates percolate through the world economy in a number of other ways, too.

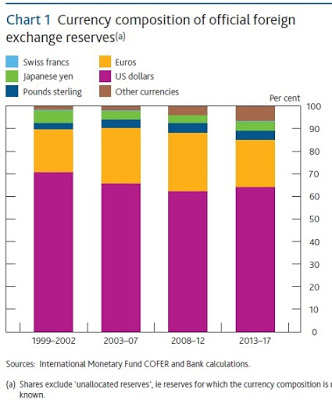

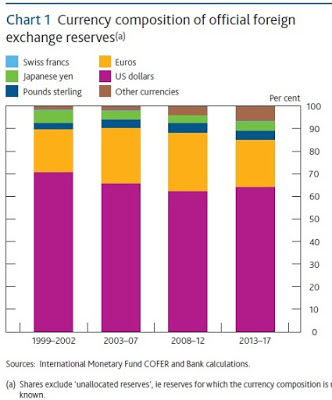

For example, central banks around the world hold “official” currency reserves, and they are mostly in US dollars.

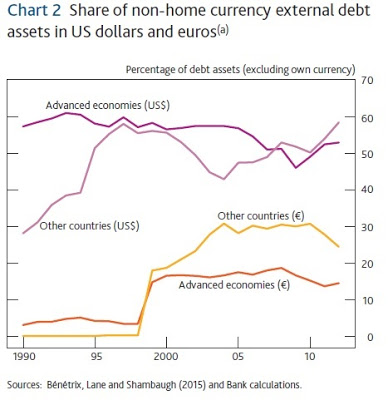

Most international borrowing also happens in US dollars, which means that those in other countries need to repay that borrowing in US dollars, which runs a risk of being difficult if there is a shift in US dollar exchange rates. For example, here’s a figure of total currency debt not in a nation’s home currency. Although euro-denominated debt has made a surge, my suspicion is that it largely replaced previous debt that had been in German marks, French francs, and the like. The share of US dollar-denominated debt is about the same as it was in the mid-1990s.

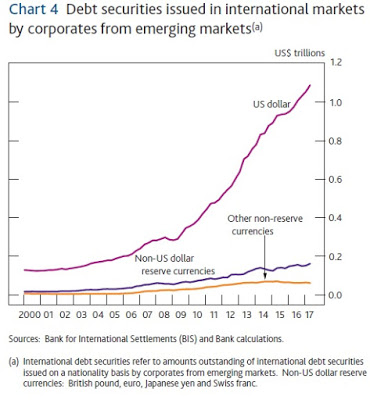

Similarly, when firms in emerging markets issue debt, they are most likely to do so in US dollars.

International bank lending to the non-bank sector in emerging markets is also mainly done in US dollars.

Finally, lots of international trade is invoiced in US dollars, even if the actual trade doesn’t involve the US economy. This matters because prices of exports and imports are often slow to adjust to exchange rate movements. As the authors write:

Leave A Comment