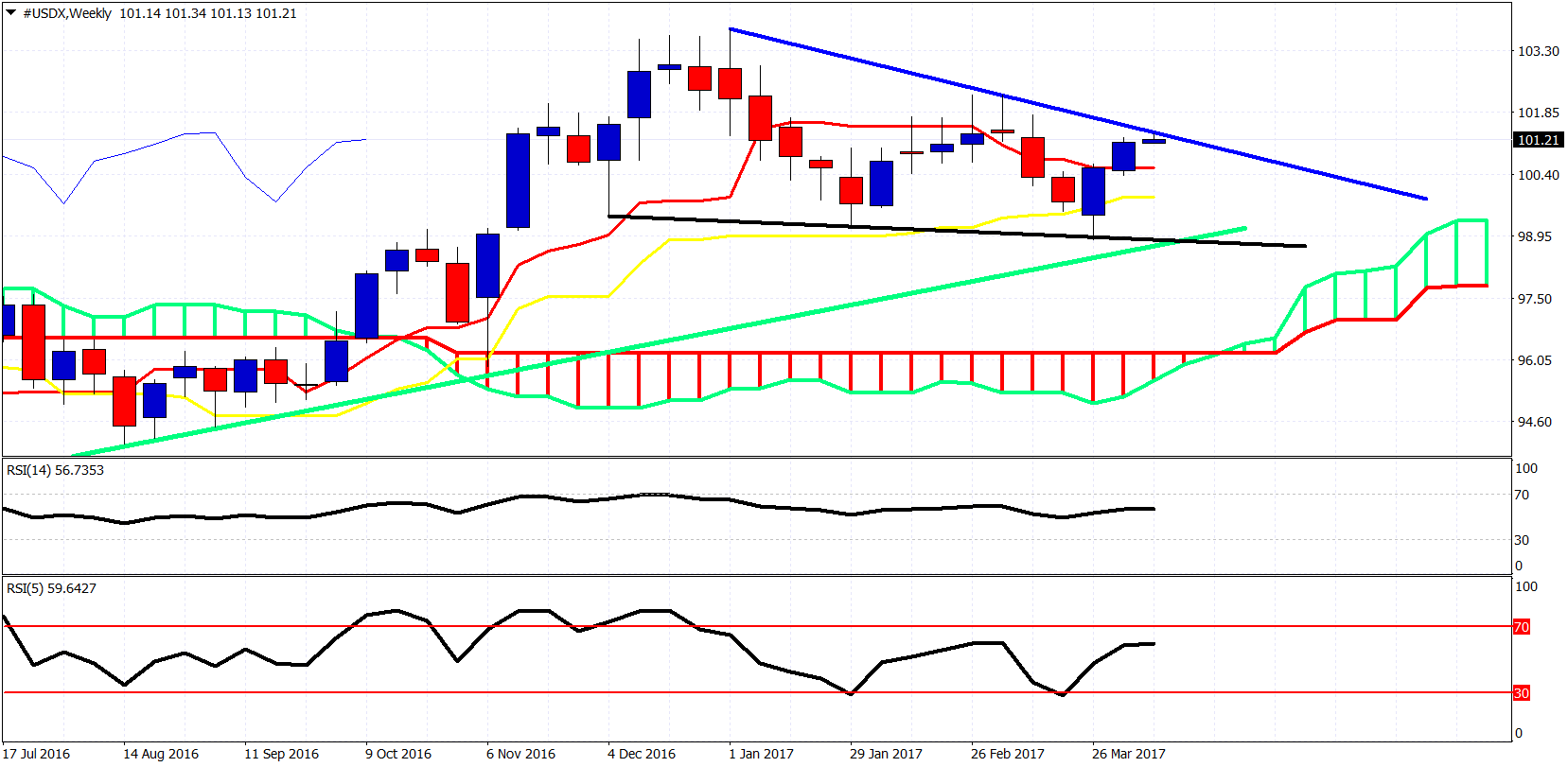

Despite the worse than expected Non-Farm Payrolls last Friday the Dollar remains well bid among most major pairs. Despite also technical indications that Dollar was overbought, there was no pull back in the Dollar index despite a small pause in the uptrend right at the important resistance at the 61.8% Fibonacci retracement.

The 101.50 price level in the Dollar index is very important resistance and I continue to believe we are going to see a rejection there first before any new upward move. My favorite scenario implies that we break below the black trend line support towards 97-96 over the next month or sooner. However, a break above 102.30 will cancel all this and bring back the bullish scenario for new highs towards 105-110 back in play again and bulls back in full control of the trend.

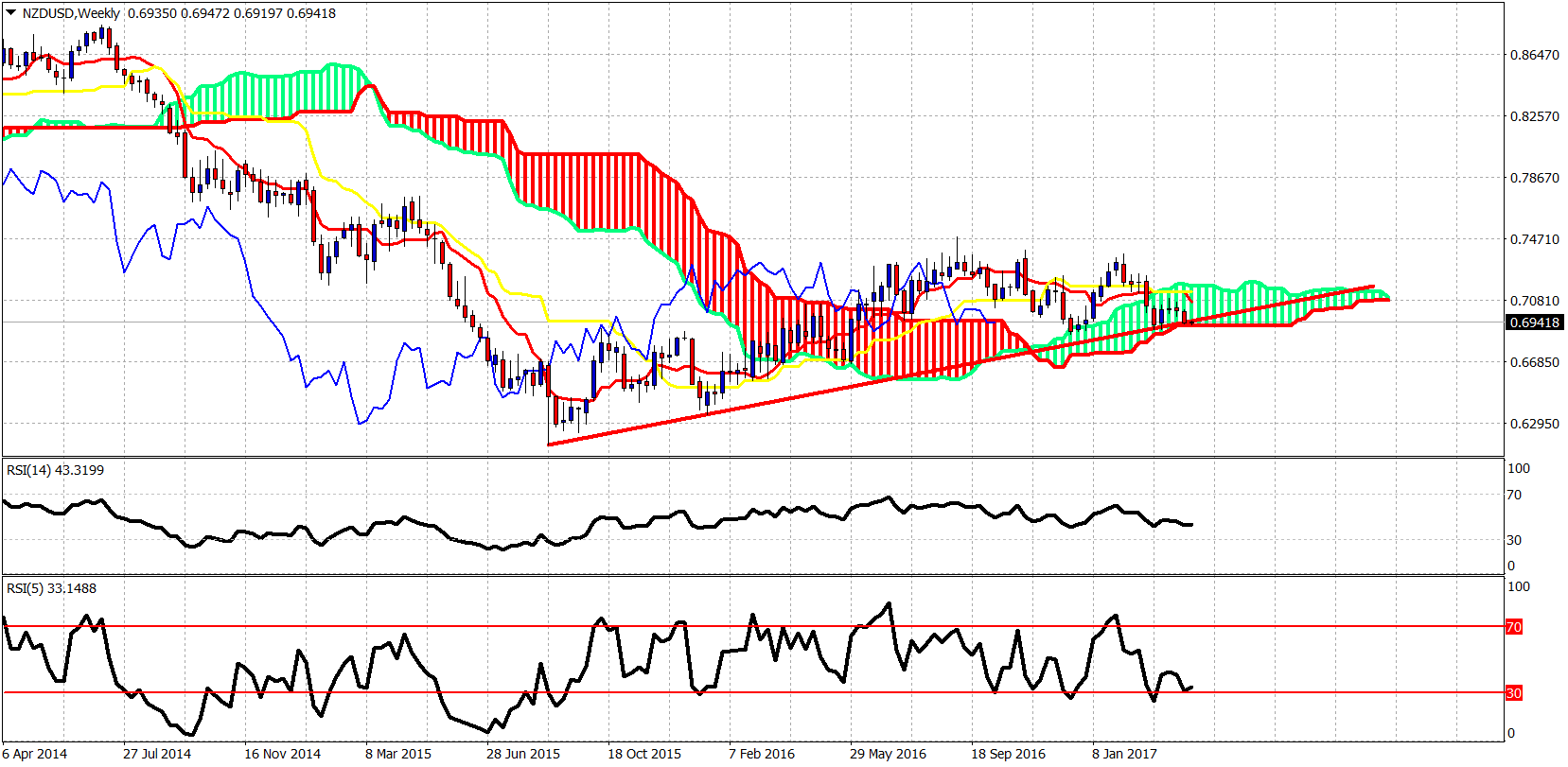

NZDUSD

Testing important long-term support at 0.69 and the risk reward favors a long position in my humble opinion.

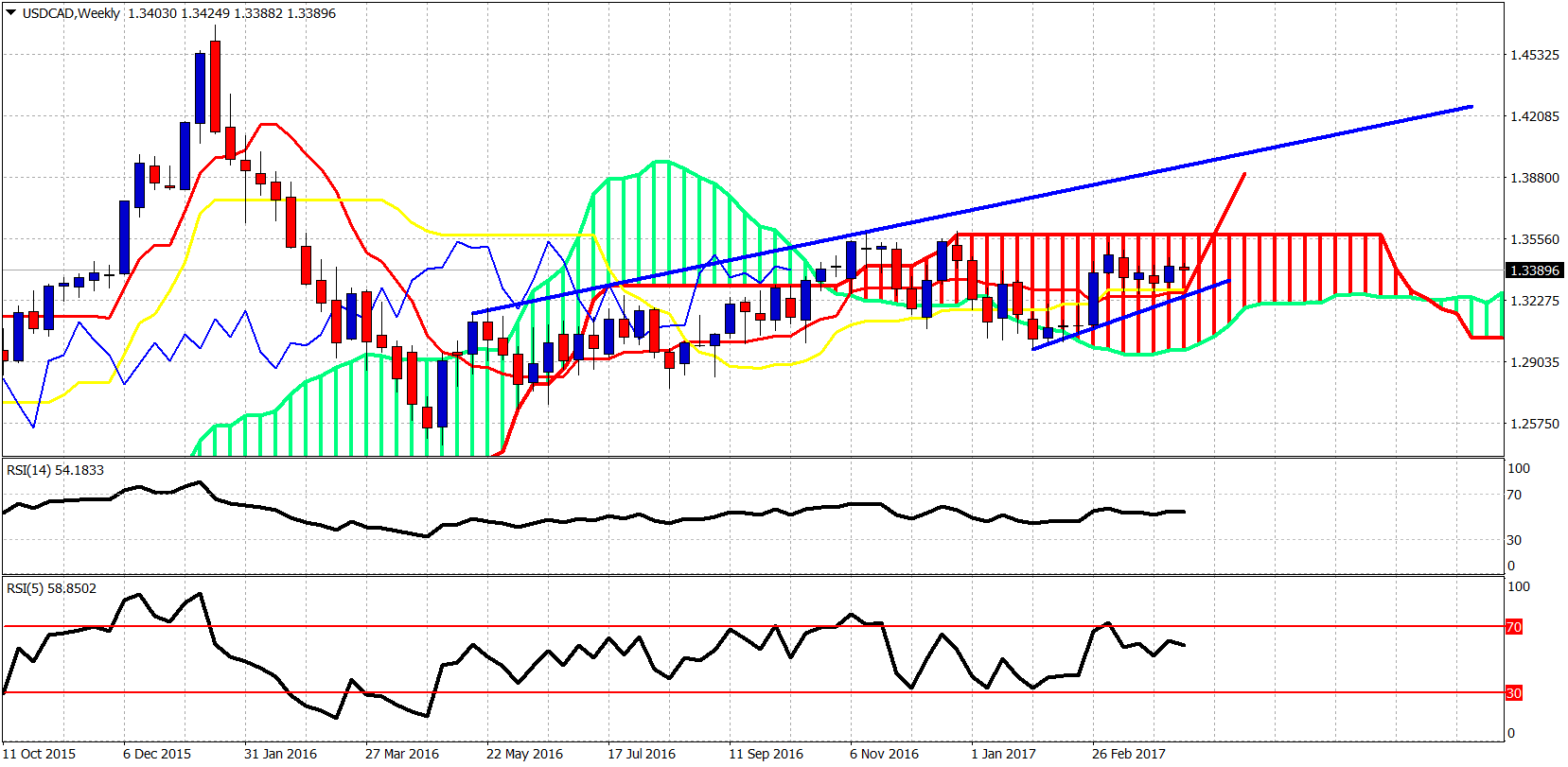

USDCAD

As long as it trades above 1.32 I can see this reaching even 1.40. The trend is bullish.

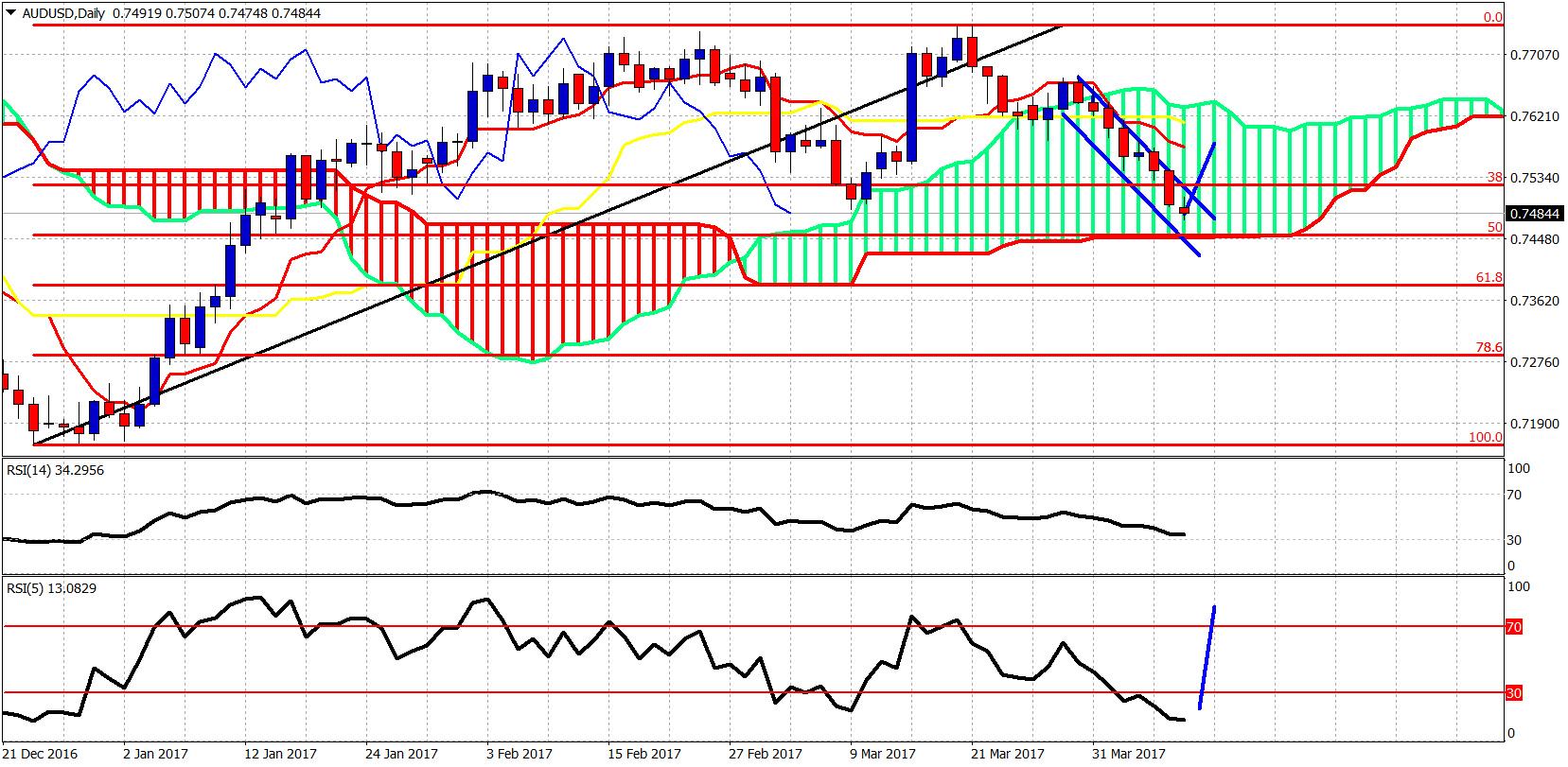

AUDUSD 0.7510 is key resistance and reversal level.

GBPUSD

Triangle broken. Price stopped at 50% Fibonacci retracement.

More pairs in the comments section. Have a nice day and Happy Easter!!!

Leave A Comment