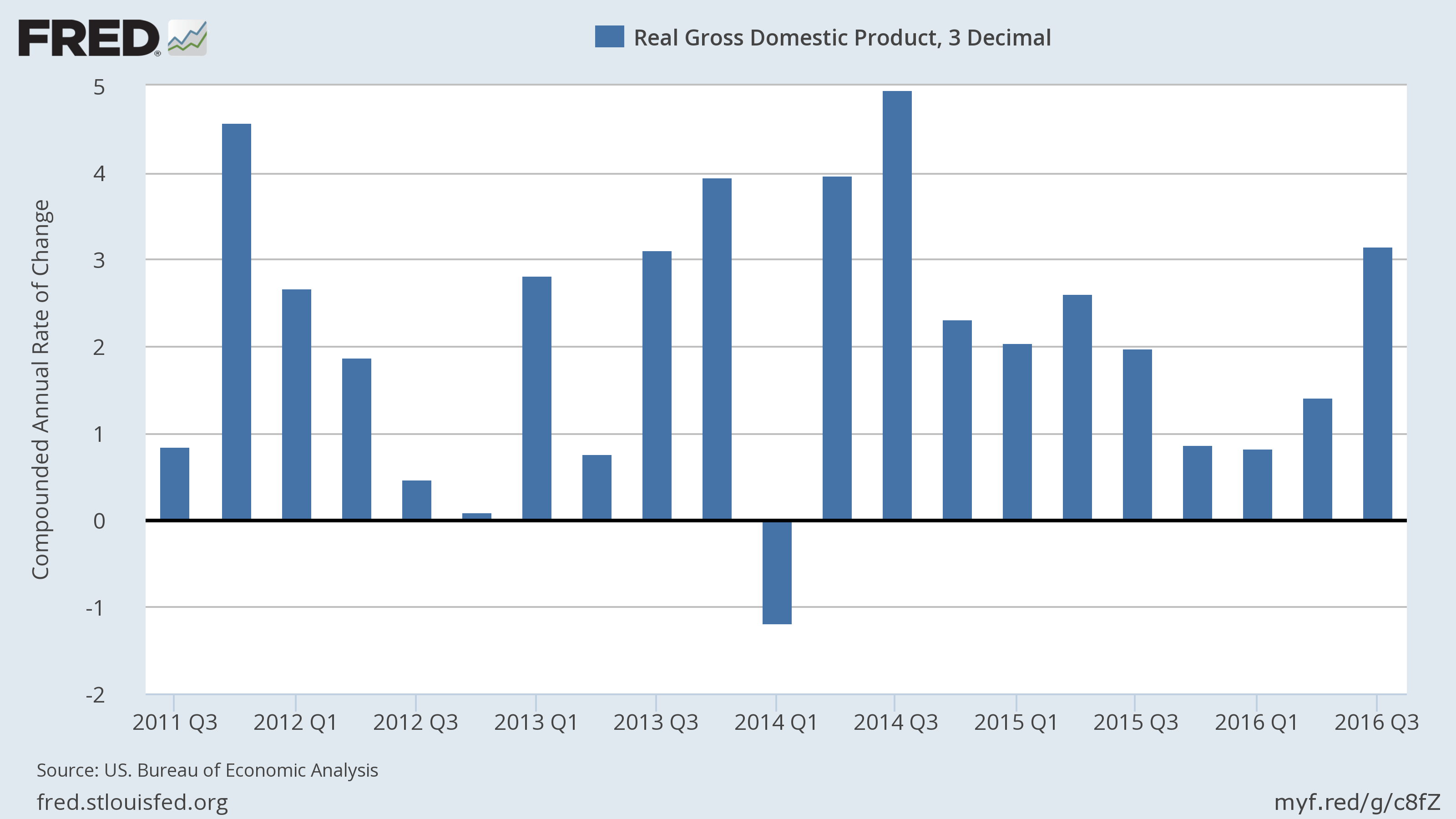

Donald Trump’s election victory last month has persuaded Mr. Market that US economic growth is destined to accelerate. The reasoning for the recent surge in the equity market: a pro-growth agenda is expected for 2017 and beyond, courtesy of a policy mix of corporate tax cuts and increases in infrastructure spending. Yet economic forecasts at the moment are calling for a relatively modest pace for the US macro trend in the near term. In fact, a number of GDP estimates point to a slower rate of growth following the 3.2% rise in GDP in this year’s third quarter. That could change, of course, once a Trump administration is running the show in the new year. At the moment, however, economic projections from various sources have yet to confirm the stock market’s recent burst of optimism.

A poll published last week noted that economic forecasts haven’t changed much since Trump’s election. “The outlook for growth and inflation in a Reuters poll also remains muted despite a Wall Street surge, underscoring a wide gap between how the economy is expected to perform by analysts and what ebullient financial markets are currently pricing in,” the news organization reported on Dec. 8.

For some perspective, let’s take a closer look at recent GDP forecasts, starting with the current Q4 nowcast via the Atlanta Fed. The bank’s GDPNow model is projecting (as of Dec. 9) that growth will ease to 2.6% in the last three months of 2016—down from 3.2% in Q3.

The Wall Street Journal’s economic survey for December sees Q4 GDP growth decelerating even more, to 2.3%, based on the average prediction. The new year doesn’t look much better. The forecast calls for a mild pickup in economic output to a 2.5% rate by 2017’s Q3. Nonetheless, the main takeaway is that economists expect that US growth will remain relatively subdued for 2017 relative to this year’s 3.2% pace in Q3.

Leave A Comment