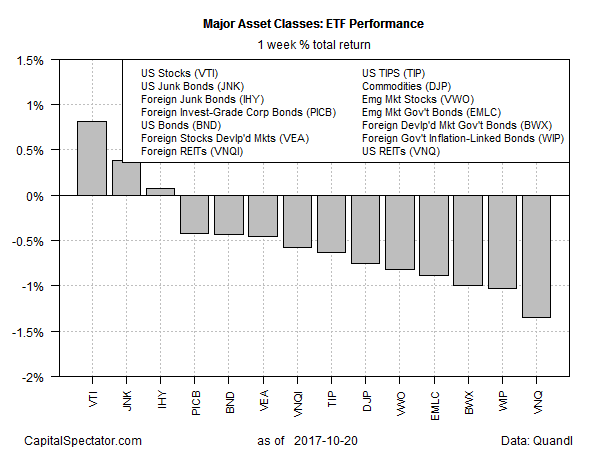

Losses dominated the major asset classes last week, based on a set of exchange-traded products. But three corners of the global markets bucked the trend with gains: US stocks, junk bonds in the US, and high-yield bonds in foreign markets.

The US stock market was the top performer for the five trading days through Oct. 20. Vanguard Total Stock Market (VTI) gained 0.8% last week, marking the ETF’s sixth consecutive weekly advance.

Last week’s biggest loser: US real estate investment trusts (REITs). Vanguard REIT (VNQ) shed 1.3%. The ETF’s slide is the first weekly setback since mid-September.

US stocks are in the lead for the one-year change too. VTI is ahead by nearly 23% over the past 12 months.

Foreign stocks are in close pursuit. The number-two performer for one-year results: Vanguard FTSE Developed Markets (VEA), which is up 22.3% vs. the year-earlier level. The third-strongest performance for the trailing one-year change: a 20.7% total return for Vanguard FTSE Emerging Markets (VWO).

Meanwhile, broadly defined commodities continue to wallow in last place for year-over-year comparisons. iPath Bloomberg Commodity (DJP) is down 0.9% vs. its year-ago price.

Leave A Comment