From NYT:

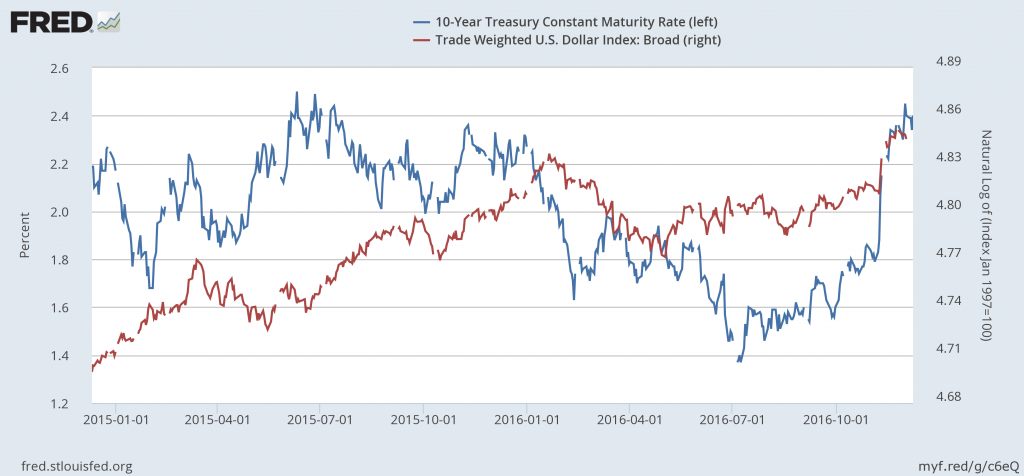

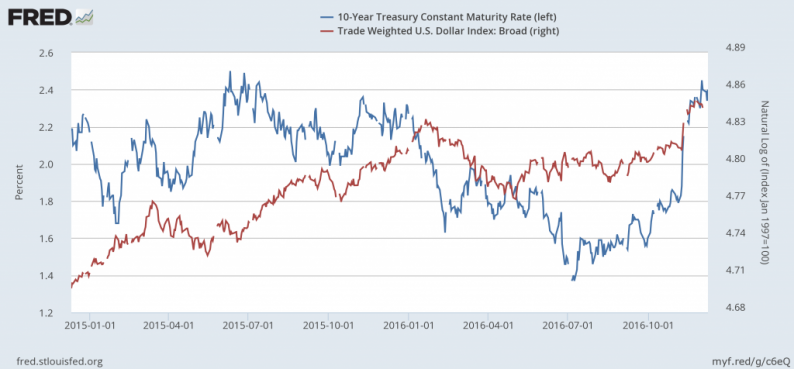

…around the globe, the surge in the dollar is provoking financial jitters.

Emerging market countries and corporations that have been binging on cheap dollar debt for more than a decade now face a spike in servicing costs and elevated debt burdens.

What can conclusions can we draw about the sensitivity of emerging markets to these developments? From Aizenman, Chinn and Ito (2016):

The results from the second step estimates that investigate the determinants of sensitivity to the (Core Economies) CE’s financial variables suggest that while the levels of direct trade linkage, financial linkage through FDI, trade competition, financial development, current account balances, and national debt are important, the arrangement of open macropolicies such as the exchange rate regime and financial openness are also found to have direct influences on the sensitivity to the CEs. As theory suggests, we find that an economy that pursues greater exchange rate stability and financial openness would face a stronger link with the CEs through policy interest rates and REER movements.

We also find that the degree of exchange rate stability and financial openness do matter for the level of sensitivity when they are interacted with other variables such as current account balances, gross national debt, trade demand, and financial development. For example, if a developing country receives higher import demand from the CEs, that would strengthen the link between the peripheral and center economies through policy interest rates when the Periphery Economy (PH) has a policy arrangement of pursuing both greater exchange rate stability and financial openness. Such a policy arrangement would also make the impact of having greater gross debt on the link between CE’s and PH’s REER. Thus, we conclude that open macro policy arrangements do have both direct and indirect impacts on the extent of sensitivity to the center economies.

We also investigate whether the exchange market pressure (EMP) of the PHs is sensitive to the movements of the CE’s policy interest rates, REER, and EMP.

Leave A Comment