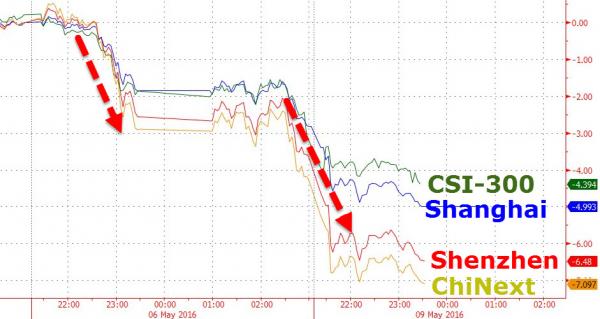

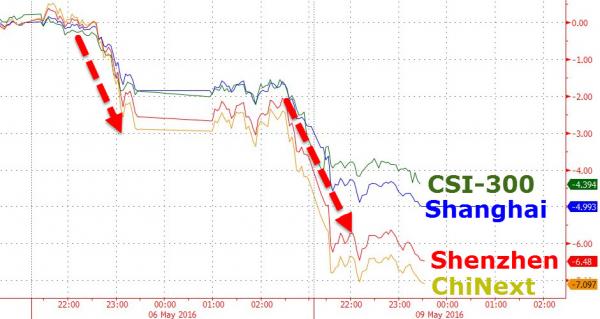

The overnight session has been one of alternative weakness and strength: it started in China where stocks tumbled 2.8% to a two month low following an unexpected warning in the official People’s Daily mouthpiece that debt and NPLs are too high, not to expect more easing will come, and that the Chinese Economy’s performance won’t be U- or V-shaped but L-shaped.

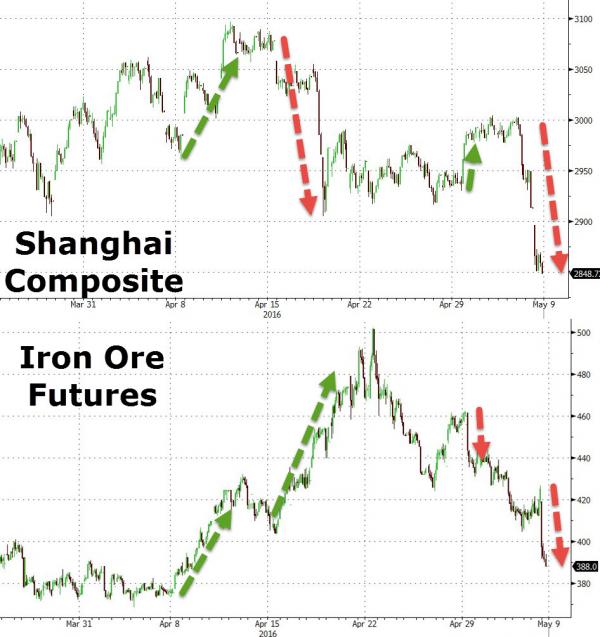

This took place after another month of disappointing, sharply weaker trade data as fears about China’s slowdown returned. An expected freefall in key commodity prices led by a crash in the iron ore complex did not help Chinese sentiment, as China’s latest commodity bubble has by now clearly burst.

Concerns about China, however, were promptly forgotten and certainly not enough to keep global assets lower, with European stocks gapping higher at the open and rallying from a one-month low, shaking off the Chinese trade data drag that pushed Shanghai shares lower along with industrial metals, driven by a “surprising” surge in the USD/JPY which has moved nearly 200 pips higher since its post-payrolls low. Another driver is the jump in oil, which rallied just shy of $46 a barrel, buoyed by Canadian wildfires that are curbing production and speculation that the Saudi Arabian oil minister succession will be bullish for oil prices.

Certainly helping Europe rebound was the latest Goldman trade recommendation which came out about an hour ago, and was as follows:

As is common knowledge always do the opposite of what Goldman recommends and at last check, the Stoxx Europe 600 Index advanced 1.4% with health care and technology companies leading the gains. Apart from mining companies, all of the 19 industry groups on the Stoxx Europe 600 Index advanced. Copper fell to its lowest in almost a month after imports into China slipped from a record, while iron ore tumbled following an increase in stockpiles at Chinese ports. Oil climbed as high as $45.94 a barrel in New York and gold retreated as a gauge of dollar strength rose for a fifth day.

S&P 500 futures added 0.3 percent, after U.S. stocks Friday halted a three-day decline amid investor speculation that the payrolls data will encourage the Federal Reserve to raise interest rates gradually. Traders are pricing in little chance of higher borrowing costs next month, with December the first month with more than even odds of a hike.

Putting the global rebound in perspective, consider that Chinese trade figures released over the weekend showed exports fell in dollar terms in April and imports dropped for the 18th month in a row, while U.S. jobs figures on Friday were weaker than economists forecast, several Federal Reserve officials have said over the past week that U.S. interest rates are headed higher, comments that have given a boost to the greenback; this happens as earnings season is set to conclude the worst quarterly report in decades.

In other words, lots of central bank multiple expansion, and lots of buybacks are taking place behind the scenes.

Euro-area finance ministers and International Monetary Fund officials are meeting Monday to decide whether Greece’s government has done enough belt-tightening to gain another aid disbursement. Germany reported a bigger increase in March factory orders than economists forecast, while companies including Enel SpA and Tyson Foods Inc. are scheduled to announce earnings.

Global Markets Snapshot

Top Global News

Looking at regional markets, Asia stocks started the week mostly lower following Friday’s NFP miss coupled with weak Chinese trade data in which exports and imports printed below estimates. ASX 200 (-0.4%) was pressured with sentiment soured by a decline in imports from its largest trading partner, although advances in oil amid uncertainty after Saudi replaced oil minister Al-Naimi helped stem losses. Nikkei 225 (+0.7%) outperformed after a 6-day losing streak as JPY weakness boosted exporter names, while the Shanghai Comp (-2.8%) led the region lower amid weak trade data and the PBoC decreasing its liquidity injection. 10yr JGBs traded lower amid increased appetite for riskier assets in Japan, while mild support was seen early in the long-end as the 20yr yield declined to fresh record lows, with the BoJ also in the market to purchase around JPY 1.2trl of government debt.

Asian Top News

Leave A Comment