The global meltup continues with the S&P set to open at new all time highs, some 20 points higher from yesterday’s close, however the driver for the latest rally is not so much the imminent BOE announcement which is expected to cut rates by 25 bps from 0.50%, but a dramatic surge in the USDJPY just after 1am Eastern when Bloomberg revealed more details about Ben Bernanke’s masterplan for Japan’s helicopter money.

According to Bloomberg, Bernanke, who met Japanese leaders in Tokyo this week, had floated the idea of perpetual bonds during earlier discussions in Washington with one of Prime Minister Shinzo Abe’s key advisers. Abe advisor Etsuro Honda said that during an hour-long discussion with Bernanke in April the former Federal Reserve chief warned there was a risk Japan at any time could return to deflation. He noted that helicopter money could work as the strongest tool to overcome deflation, according to Honda. Bernanke noted it was an option. The implication, as we said last week when we previewed just this “big thing” is that Japan is indeed set to be the first testing ground of helicopter money in the modern financial system.

Though Honda said he thought Japan was already engaged in a strategy that involved helicopter money, he said that he watned to convey the idea to Abe and asked Bernanke to meet with the premier in Japan. While this didn’t happen in the spring, Bernanke joined central bank chief Haruhiko Kuroda over lunch this Monday and on Tuesday he attended a gathering with Abe and key officials, including Koichi Hamada, another influential economic adviser.

Honda, 61, said he told Abe about Bernanke’s views after his April meeting. “I told him now is the time for Japan to expand fiscal spending and at the same time, additional monetary easing should be taken,” Honda said. “I told him it is necessary to strengthen the effects of Abenomics” through such a strategy.

While nothing definitive has been revealed by Japan yet, bond, stock traders and economists have been mulling the possible implications of Bernanke’s visit and the next steps to come in Abenomics. Amid intense speculation about the chances of helicopter money, and the certainty of further fiscal stimulus ordered by the prime minister, Japanese shares have rallied for four consecutive days while the yen has weakened. The Japanese currency weakened sharply in late afternoon trading in Tokyo, and reached just shy of 106 around 6am ET, having soared nearly 600 pips in the past 4 days.

And with the Yen – the world’s carry currency – plunging, global stocks have climbed with U.S. equity index futures.European shares rose to a three-week high and emerging-market equities advanced for a sixth day. South Africa’s rand and Russia’s ruble were among the biggest gainers against the yen after a gauge of metal prices climbed to a nine-month high and oil rebounded from a two-month low. The pound advanced as traders awaited the Bank of England’s first interest-rate decision since the U.K. voted to leave the European Union.

“The expectations of a two-pronged stimulus approach — both fiscal and monetary — have definitely put the yen under pressure,” said Peter Dragicevich, a foreign-exchange strategist at Commonwealth Bank of Australia in London.

Meanwhile, as Japan prepares to formalize helicopter money, the BOE is set to ease in a more conventional way in less than an hour: “Everyone is focused on the BOE and whether or not they will announce more stimulus and cut rates.”

The Stoxx Europe 600 Index rose 1 percent at 10:55 a.m. in London, paring its losses since Britain’s referendum on June 23. All industry groups in the gauge climbed, led by carmakers and commodity producers. The MSCI Emerging Markets Index added 0.7 percent in its longest winning streak since April. The gauge advanced to 8.6 percent this year and trades at the highest valuation in more than a year. The MSCI World Index of developed markets has gained 2.1 percent in 2016.Futures on the S&P 500 Index added 0.8%. BlackRock and JPMorgan are scheduled to report earnings before the market opens. Yum! Brands Inc. jumped 3.1 percent as the company raised its forecast after its KFC chain performed better than expected in China. Analysts predict second-quarter profits will drop 5.7 percent at S&P 500 firms, which would make it the fifth straight quarterly decline, the longest streak since 2009.

Sovereign debt fell in the U.S., the U.K., Japan and Germany. The yield on U.S. Treasuries due in a decade rose two basis points to 1.50 percent, while that on Japanese debt increased by two basis points to minus 0.26 percent. Yields climbed four basis points in the U.K. and Germany to 0.78 percent and minus 0.05 percent, respectively.

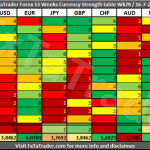

Global market snapshot

Leave A Comment