US futures were little changed, with European shares lower, and Asian stocks higher as caution returned after last night’s Chinese economic data did little to clear up how the world’s second largest economy is performing, and provided few positives for investors ahead of the third and final U.S. presidential debate; imminent announcements from both the ECB and the Fed also will keep traders on their toes today.

All eyes, however, will be on the third U.S. presidential debate on Wednesday night in Las Vegas, which comes as opinion polls show a substantial lead for Hillary Clinton over Donald Trump.

The U.S. dollar fell from a seven-month peak on Wednesday, combining with signs of an easing supply glut to help lift oil prices back towards a one-year high. The weaker dollar boosts oil, which gained over 1 percent on Wednesday, pushing WTI over $51. The bounce in commodity prices has helped bolster inflation expectations in the euro zone, nudging the bloc’s bond yields further away from the record lows struck after Brexit.

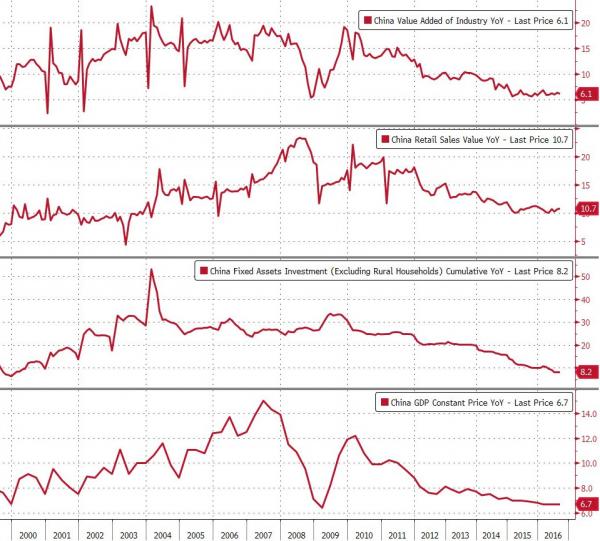

The overnight mood was set by a relatively uneventful set of Chinese economic reports, which saw a GDP and Retail sales meet expectations, while Industrial Production missed modestly.

The MSCI All Country World Index of shares was unchanged after rallying in the last session by the most in almost a month. Hong Kong stocks swung to a loss, while Chinese equities and the Australian dollar erased gains after an unexpected slowdown in China’s industrial output cast a cloud over gross domestic product figures that matched estimates. The Dollar remained near a one-week low following U.S. inflation data that damped expectations for interest-rate hikes. Crude oil rose after data showed American supplies fell, while aluminum dropped.

“China won’t do anything new in terms of policy because the economy isn’t sliding,” said Ben Kwong, a Hong Kong-based director at KGI Asia Ltd. “Under these conditions, the market doesn’t really have a direction. It needs to wait for news on U.S. rates.”

European stocks retreated as investors assessed Chinese data for indications of the health of the global economy, while awaiting updates from the European Central Bank and Federal Reserve. The Stoxx Europe 600 Index was down 0.2 percent as of 8:16 a.m. London time, after surging 1.5 percent on Tuesday. ASML Holding NV jumped by the most in eight months after Europe’s largest semiconductor-equipment maker forecast profitability above analysts’ estimates for the final three months of the year.

The MSCI Asia Pacific Index added 0.3 percent, having been up 0.4 percent prior to the China data. The Hang Seng Index declined 0.5 percent and the Shanghai Composite Index was little changed. China’s gross domestic product expanded 6.7 percent in the last quarter from a year earlier, the third straight period at that pace. Industrial output rose 6.1 percent, less than the median forecast for a 6.4 percent gain.

S&P 500 futures slipped were unchanged after the underlying gauge added 0.6 percent on Tuesday. While only 57 of the benchmark’s members have reported results so far, about 80 percent announced earnings that exceeded analysts’ estimates, according to data compiled by Bloomberg.

The yield on US 10Y Treasuries was little changed at 1.74%. It fell three basis points on Tuesday as core inflation, which excludes energy and food costs, came in weaker than economists estimated. The probability of the Fed hiking interest rates this year slipped by three percentage points in the last session to 63 percent, futures prices indicate. Australia’s 10-year bonds gained for the first time in four days, pushing their yield four basis points lower to 2.30 percent. The rate on similar-maturity U.K. notes increased by two basis points to 1.10 percent.

Market Snapshot

Top Global Headlines

Leave A Comment