With unaffordability reaching levels not seen in decades across some of the most expensive urban markets in the US, a housing-market rout that began in the high-end of markets like New York City and San Francisco is beginning to spread. And as home sales continued to struggle in August, a phenomenon that realtors have blamed on a dearth of properties for sale, those who are choosing to sell might soon see a chasm open up between bids and asks – that is, if they haven’t already.

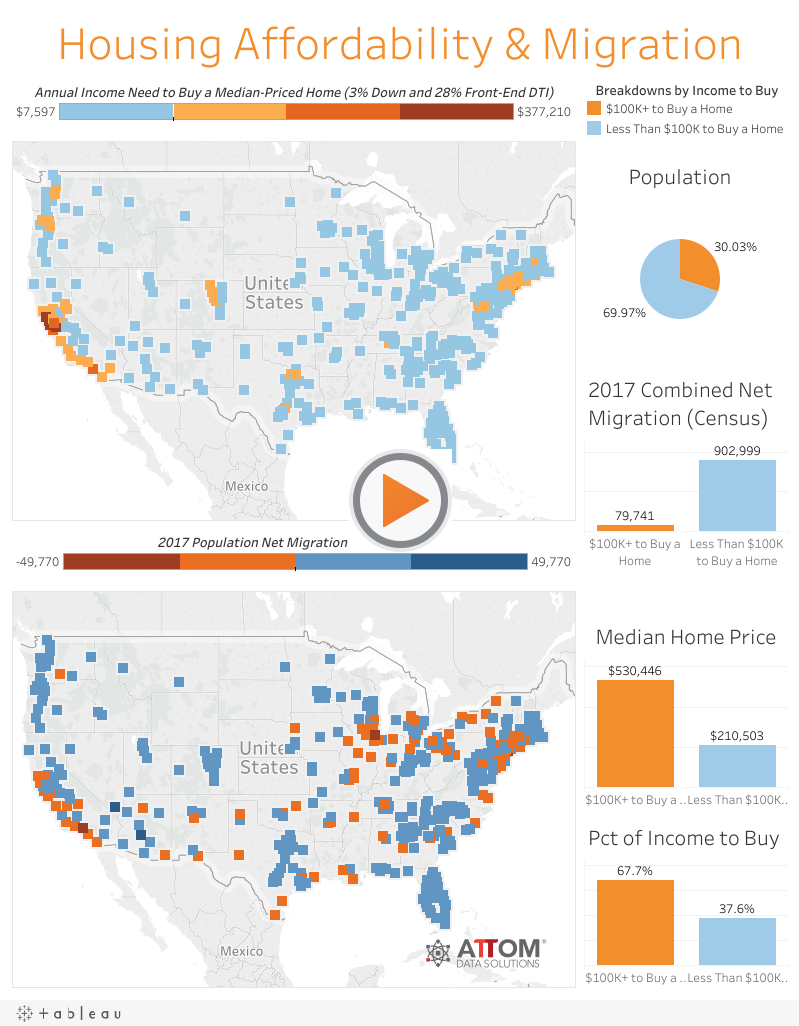

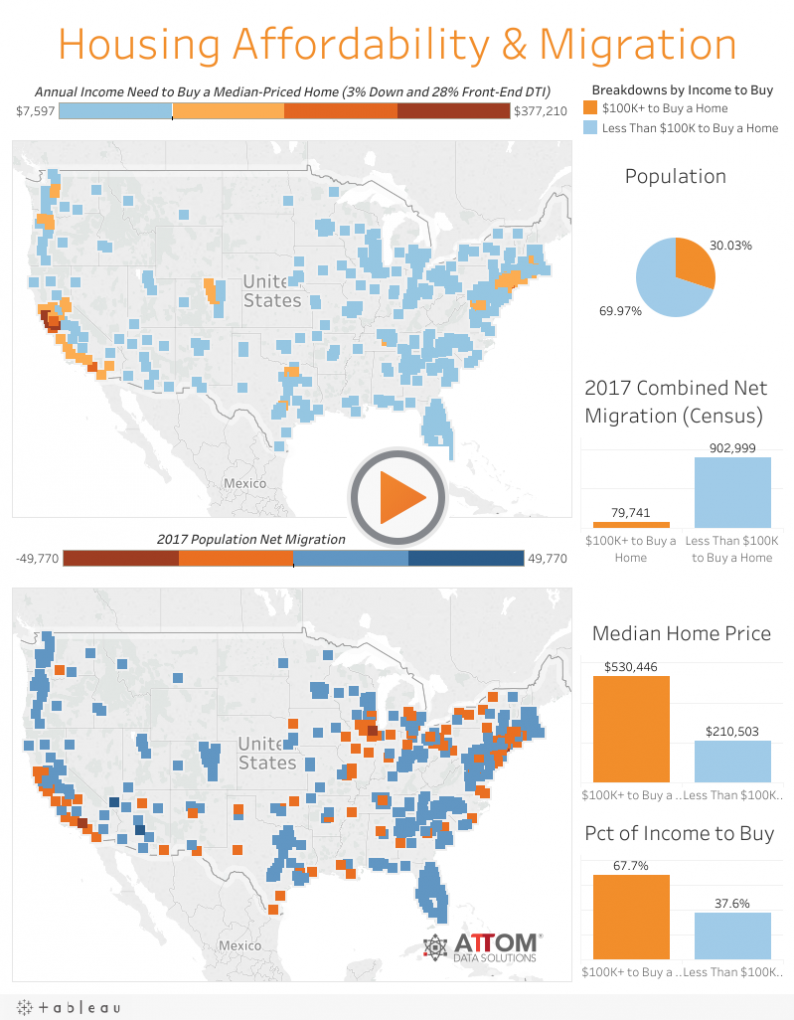

While home unaffordability is most egregious in urban markets, cities don’t have a monopoly on unaffordability. According to a report by ATTOM, which keeps the most comprehensive database of home prices in the US, of the 440 US counties analyzed in the report, roughly 80% of them had an unaffordability index below 100, the highest rate in ten years. Any reading below 100 is considered unaffordable, by ATTOM’s standards. Based on their analysis, one-third of Americans (roughly 220 million people) now live in counties where buying a median-priced home is considered unaffordable. And in 69 US counties, qualifying for a mortgage would require at least $100,000 in annual income (Assuming a 3% down payment and a maximum front-end debt-to-income ratio of 28%). As one might expect, prohibitively high home prices are inspiring some Americans to relocate to areas where the cost of living is lower. US Census data revealed that two-thirds of those highest-priced markets experienced negative net migration, while more than three-quarters of markets where people earning less than $100,000 a year can qualify for a mortgage experienced net positive migration.

ATTOM illustrated this correlation between home affordability and net migration in the chart below:

Rising home prices have played a big part in driving home unaffordability, but they’re not the whole story. Stagnant wages are also an important factor. The median nationwide home price of $250,000 in Q3 2018 climbed 6% from a year earlier, which is nearly twice the 3% growth in wages during that time. Looking back over a longer period, median home prices have increased 76% since bottoming out in Q1 2012, while average weekly wages have increased 17% over the same period.

Leave A Comment