We’ve discussed the price to income ratio of housing in a previous article. This gave us an idea of how expensive housing has become. We’ll discuss some of best points why real estate is too expensive and then provide the counterpoint explaining why housing isn’t in a bubble.

Housing Isn’t Affordable

In a May survey of those living in the top 25 metropolitan statistical areas, 52% of respondents said the lack of available housing that is affordable is a big problem and 24% said it isn’t a problem. In 2005, which was near the peak of the housing bubble, 51% said this was a big problem and 28% said it wasn’t a problem. As you can see, this poll shows more people thought housing was unaffordable in 2017 than during the 2008 housing bubble.

The problem is so bad, there was a recent survey in Palo Alto which asked if residents considered themselves middle class. Some respondents making as much as $400,000 per year stated that they were in the middle class. This isn’t an example of rich people who are out of touch with reality; housing is so expensive, it cripples people. The median household income in Palo Alto is $137,000 and the income per capita is $79,000. This is a problem because the median sale price of homes is $3 million. Homes sell at 110% of the list price. This is consistent with the previous polling we mentioned because when you break down that poll by geography, the pacific coast has the highest percentage who said housing affordability is a big problem (69%). Price inflation has also been significant on the West coast. The situation isn’t as bad outside of metro areas as only 36% said affordability was a big problem.

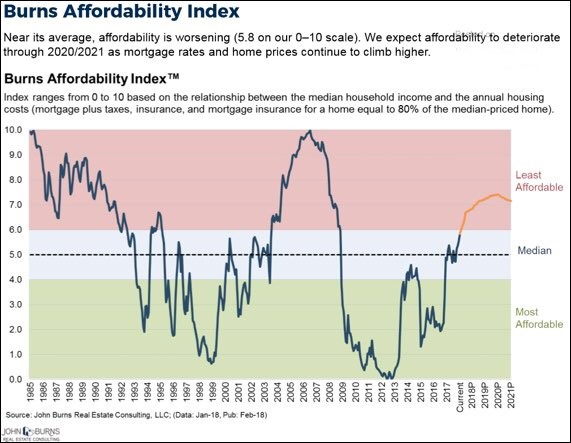

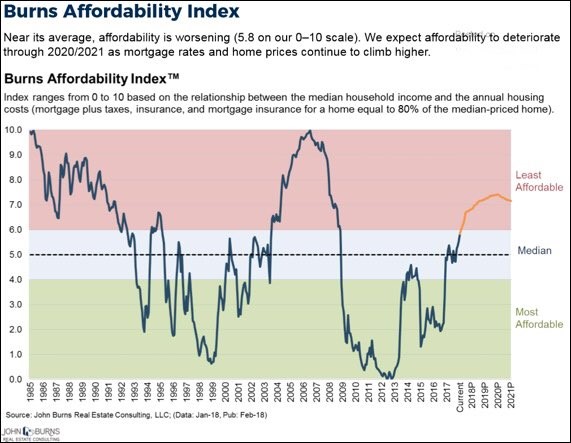

The chart below is the John Burns affordability index.

Housing About to Become Unaffordable

The John Burns Affordability Index calculates the relationship between median incomes and housing costs such as the mortgage, taxes, insurance, and mortgage insurance equivalent to 80% of the home. The current situation is near the cusp between the median and least affordable markers. It is expected to be in the least affordable category in the next year. Keep in mind, if interest rates rise, the affordability index will quickly spike.

Leave A Comment