In February 2018, it was like old times for the US industrial sectors. Prior to the 2015-16 downturn, the otherwise moribund economy did produce two genuine booms. The first in the auto sector, the other in energy. Without them, who knows what the no-recovery recovery would have looked like. They were for the longest time the only bright spots.

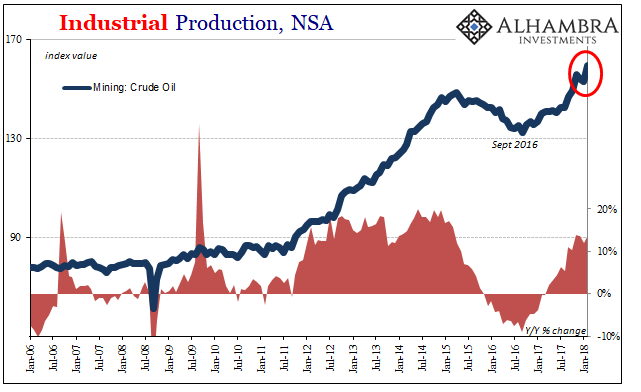

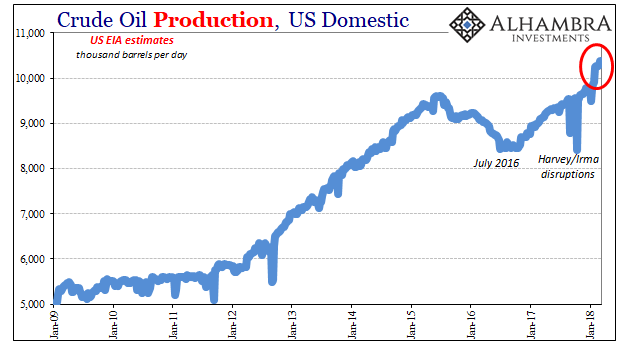

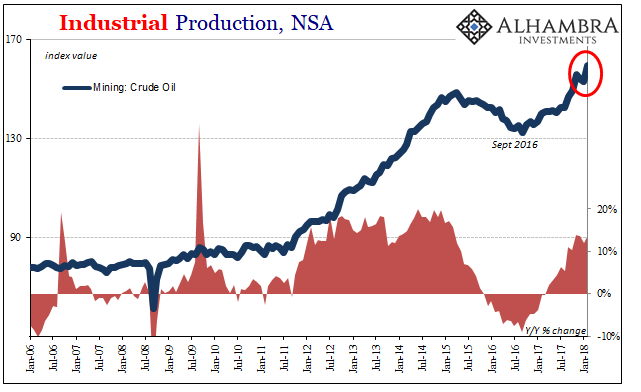

The oil sector has roared back on the flight of oil prices off the February 2016 lows. Even before the Federal Reserve’s latest estimates on Industrial Production, released today, we knew that the mining portion was on fire due to shale. The US EIA figures for domestic oil production, for example, registered a massive increase in February (based on what isn’t clear; there was, evidently, some kind of stoppage or slowdown in crude production in January showing up in both data series).

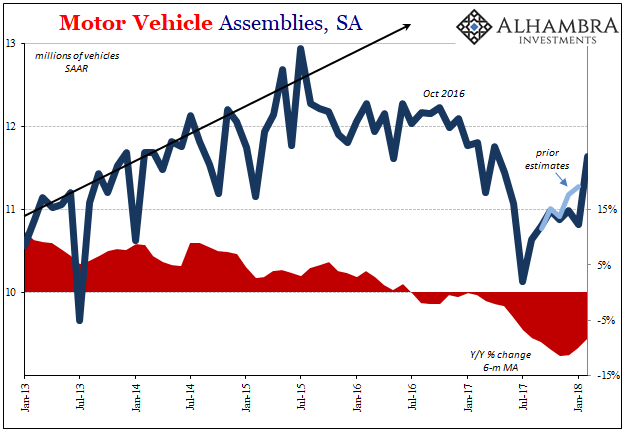

The good fortune in mining was shared by auto production. After revising January’s estimates for Motor Vehicle Assemblies down by a significant amount, the Federal Reserve stats pushed domestic auto production in February up by a substantial amount for largely unknown reasons. Auto sales haven’t changed; in fact, after the hurricanes’ temporary destructive assist, vehicle purchases have dropped back down toward last summer’s weak levels.

I’d really hate to say it’s weather, but in both sectors autos and energy it does appear as something like it. Lousy January sales were blamed on snow storms at the beginning of that month, and it’s possible given their Midwestern attention that production was scaled back a bit along with them – only to be ramped up in February to make up for lost time (I haven’t seen any reports, however, of plant outages in that timeframe).

It’s also possible that automakers dismissed January’s sales because of winter as well as it having been January.

“January historically is the weakest month of the year. It’s tough to read a whole lot into January,” said Erich Merkle, U.S. sales analyst for Ford.

Leave A Comment