US economic data of late have been coming in strong. Real GDP printed 4.1 percent growth in 2Q18. This was the strongest growth rate in 15 quarters. As of last Friday, the Atlanta Fed’s GDPNow model expects 4.4 percent growth in the current quarter. This is well above not only the post-Great Recession average of 2.3 percent but also the long-term average going all the way back to 2Q47 of 3.2 percent. Thus the question, is the momentum sustainable?

Manufacturing cooled down in July. The ISM manufacturing index dropped 2.1 points month-over-month last month to 58.1. February’s 60.8 was the highest since May 2004. So activity is softening from a very elevated level, and could go down a lot in a worse-case scenario.

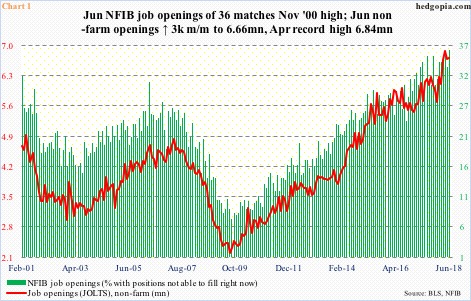

Non-farm job openings for June were published Tuesday. They inched up 3,000 m/m to 6.66 million. April’s 6.84 million was the highest ever. The JOLTS data is in agreement with NFIB job openings. The latter in June rose three points m/m to 36, which matched the all-time high of November 2000.

It is just one month, but at this point in the cycle even the slight softening in the red line in Chart 1 cannot be brushed off as if it was nothing. Too soon to say it is a chink in the jobs armor, but June also saw softening in another JOLTS metric.

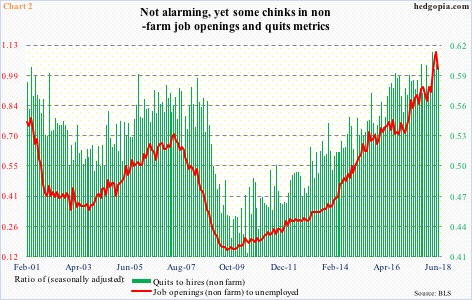

One of the signs of a healthy job market is employees’ willingness or ability to quit. These are voluntary separations initiated by employees, hence reflect conviction that they would not have a problem finding another. In May, there were 3.48 million quits. This declined to 3.4 million in June. Not a big deal, but still a drop is a drop.

In Chart 2, there are two ratios – quits to hires and job openings to unemployed. Hires, too, peaked in May, at 5.75 million, with June at 5.65 million. The quits-to-hires ratio was 0.6 in June, having peaked at 0.617 in March. Ideally, a rising ratio is good. Similarly, the ratio of job openings to unemployed came in at 1.01 in June, down from a high of 1.1 in the prior month. Once again, a rising ratio reflects underlying strength.

Leave A Comment