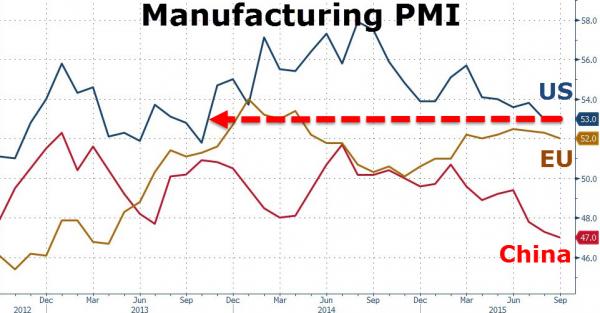

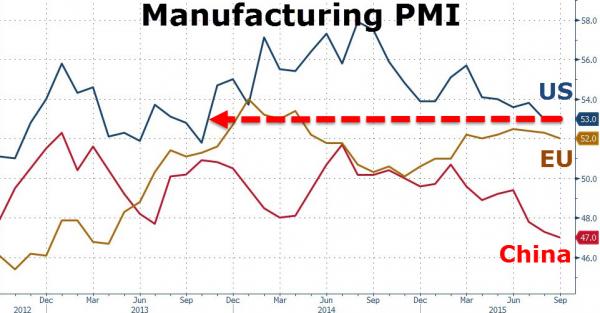

On the heels of dismal China manufacturing data (worst PMI since March 2009) and mixed-to-weaker European data, US Manufacturing PMI printed a September preliminary 53.0 (flat from 53.0 in August and modestly better than expectations of 52.8). This is the equal lowest print since Oct 2013. Underlying components are mixed (factory prices dropped for first time in 3 years and new orders and employment slowed), but, confirming what Yellen told us last week (that the US economy is to fragile to handle a 25bps rate hike), Markit notes, “the sluggish growth, weaker forward-looking indicators and downturn in price pressures all point to the Fed holding off with rate hikes until next year.”

It appears US decoupling is once again proved a timing issue more than reality…

Factory gate charges dropped for the first time since August 2012. Anecdotal evidence from survey respondents suggested that falling commodity prices, intense competitive pressures and softer demand conditions were all factors contributing to price discounting in September.

Commenting on the flash PMI data, Chris Williamson, chief economist at Markit said:

“Manufacturing remained stuck in crawler gear in September, fighting an uphill battle against the stronger dollar, slumping demand in many export markets and reduced capital spending, especially by the energy sector.

“The survey is indicating the weakest manufacturing growth for almost two years,meaning the sector will have acted as a drag on the economy in the third quarter.

“The disappointing performance of the goods producing sector has so far been offset by stronger expansion in the larger services sector, which means the economy looks to have grown at a reasonable 2.5% annualised pace in the third quarter, but there are question marks over whether this growth can be sustained as we move towards the end of the year. Inflows of work showed the smallest rise since the start of 2014, and job creation has also slowed.

“The sluggish growth, weaker forward-looking indicators and downturn in price pressures all point to the Fed holding off with rate hikes until next year.”

Leave A Comment