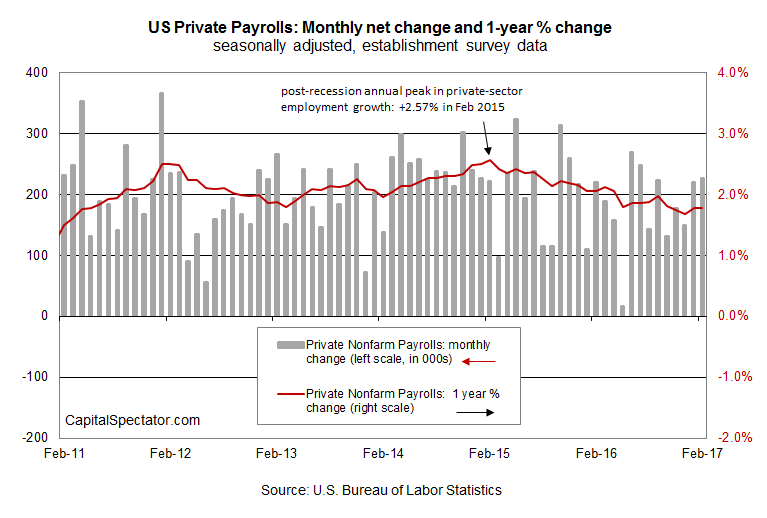

Companies added more workers to payrolls in February, the Labor Dept. reports. Private-sector payrolls increased 227,000 last month, modestly higher than January’s revised 221,000 advance. A second month of robust expansion of the labor market gives the Federal Reserve another reason to hike rates at next week’s monetary policy meeting. But while the monthly change has rebounded this year after weak growth in 2016’s third quarter, the year-over-year trend was unchanged last month, holding at a relatively subdued increase.

Firms raised employment by 1.78% in February vs. the year-earlier level, matching January’s pace. That’s a healthy rate, but the lack of acceleration in the annual change contrasts with Wednesday’s news that ADP’s estimate of private-sector employment’s year-over-year trend ticked higher for the second month in a row.

Nonetheless, it’s clear that the labor market’s forward momentum remains intact, although the improvement this year may be partly due to unseasonably warm weather. February was the second-warmest on record, according to the National Oceanic and Atmospheric Administration. Is that a clue for thinking that the recent uptick in payrolls growth could reverse in the months ahead? Perhaps, but taking the numbers at face value today leaves little room for gloomy forecasts for payrolls or the economy.

Today’s upbeat employment report also strengthens the case for expecting that the Federal Reserve will lift its target Fed funds rate next Wednesday, when the central bank releases its monetary policy statement. By some accounts, a new round of policy tightening is virtually assured, inspiring a deeper focus on how many times the Fed will hike this year. As the Financial Times reports:

Today’s update is “definitely a solid report,” Tara Sinclair, an economist at George Washington University tells The Washington Post. “This is the kind of number that the Federal Reserve was looking to receive before their meetings next week.”

Leave A Comment