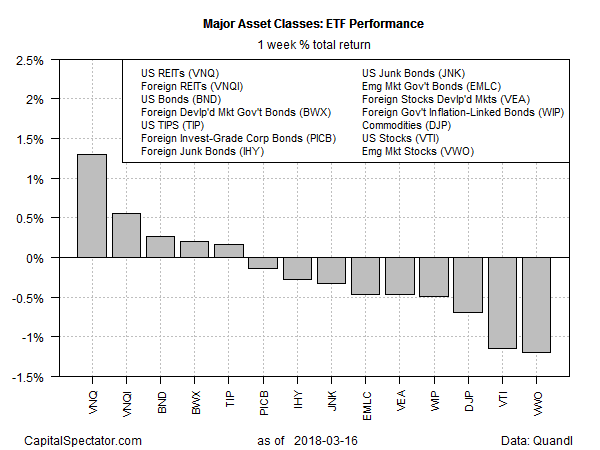

Real estate investment trusts (REITs) in the US posted a second straight gain last week, topping performances for the major asset classes, based on a set of exchange-traded products.

Vanguard Real Estate (VNQ) jumped 1.3% for the five trading days through Mar. 16. Adding in the previous week’s gain translates into VNQ’s best two-week run in more than a year, albeit after months of weakness.

Last week’s performances were mixed overall for the major asset classes. On the downside, emerging markets stocks suffered the biggest decline. FTSE Emerging Markets (VWO) fell 1.2% last week.

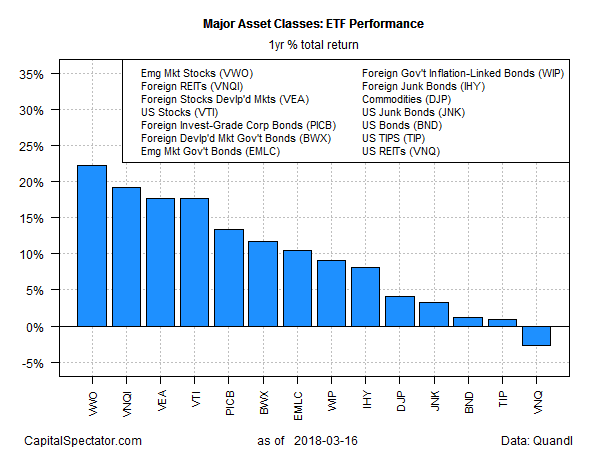

For the one-year trend, the leader and laggard pair is exactly opposite to last week’s results. Equities in emerging markets (VWO) continued to post the strongest total return (+22.3%) while US REITs (VNQ) are in last place with a 2.7% loss.

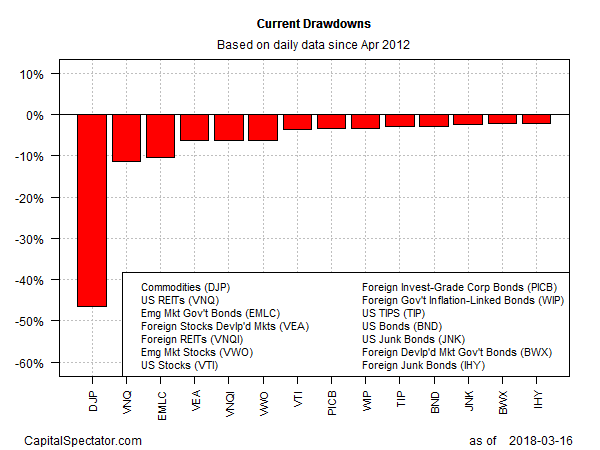

Stacking up the major asset classes based on current drawdown reveals that broadly defined commodities are still suffering from the biggest peak-to-trough decline for the major asset classes. The drawdown for iPath Bloomberg Commodity (DJP) at last week’s close was a steep -46%. Meanwhile, foreign junk bonds via VanEck Vectors International High Yield Bond (IHY) has the smallest drawdown at the moment of just -2.1%.

Leave A Comment