US Session Bullet Report

Revised Q2 figures for the eurozone showed that GDP has increased by 0.4% as opposed to 0.3% previously. EU powerhouse Germany saw imports and exports hit record highs in July, pushing the trade surplus to 22.8 billion euros, better than expected.

As a result, eurozone stocks are heading for their best day in more than 2 months as investors latch on to market opportunities. The German DAX is trading up almost 200 points at time of writing and the FTSE 100 also making strong gains.

USD has also enjoyed a strong revival, notably against the EUR and JPY. The greenback started the EU session being sold off but has since recovered. From a high of 1.1228 against the EUR, it is now trading at 1.1157 and from a low of 118.870 against the JPY, is now trading at 119.985 at time of writing.

Elsewhere, Oil has broken out above its earlier pivot and is now trading at $45.60. Gold remains stuck in a tight range of the last few days around 1122.

With the US session due to open soon, it will be interesting to see if the positive sentiment carries over from Europe. On the recent selloff, Mark Schwartz of Goldman Sachs’ was recently quoted as saying, “I think the market reaction globally is overdone” so as September rolls on, speculation will again begin on whether the US will be lifting its interest rate this month.

Trading quote of the day:

“Without action, the best intentions in the world are nothing more than that: intentions.”

– Jordan Belfort

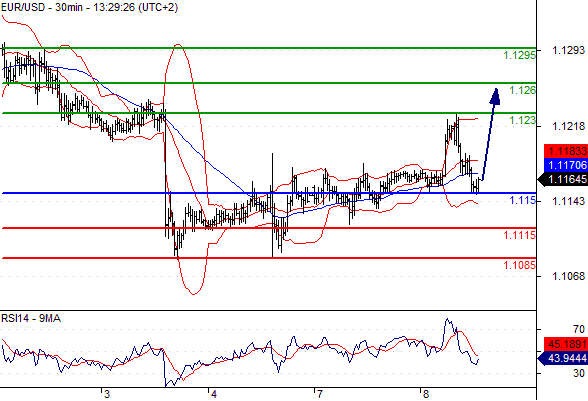

EURUSD

Pivot: 1.115

Likely scenario: Long positions above 1.115 with targets @ 1.123 & 1.126 in extension.

Alternative scenario: Below 1.115 look for further downside with 1.1115 & 1.1085 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

GBPUSD

Pivot: 1.532

Likely scenario: Long positions above 1.532 with targets @ 1.541 & 1.544 in extension.

Alternative scenario: Below 1.532 look for further downside with 1.529 & 1.5265 as targets.

Comment: The RSI is well directed.

Leave A Comment