US Session Bullet Report

The USD still continues to dominate today albeit with a weaker tone. Initially USD was supported by another round of weak Chinese data, however later comments leaking from 2 ECB members where they stated that they will likely not proceed with more QE, helped support the EUR towards 1.1170 from 1.1100. More on this will likely be revealed by ECB President Mario Draghi who is scheduled to speak later at 13:00 GMT. Investors will be looking for clues into whether the ECB is contemplating expanding its bond-buying program.

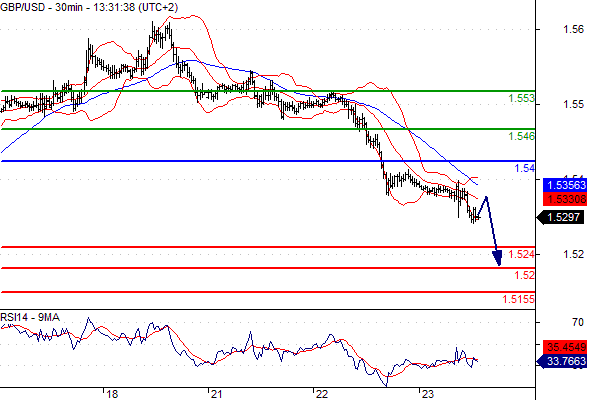

Outlook on the GBPUSD on the other hand looks bleak especially after breaking 1.53 and trading as low as 1.5265. 1.5160 levels reached in September are now the next support targets.

Stocks are in a recovery mode in EU today following the Asian selloff as the dust over the VW scandal has temporarily settled down. The only other highlight of the afternoon besides Draghi, will be the USD release of Manufacturing PMI, however impact should be limited.

Trading quote of the day:

“What seems too high and risky to the majority generally goes higher and what seems low and cheap generally goes lower. -William O’Neil

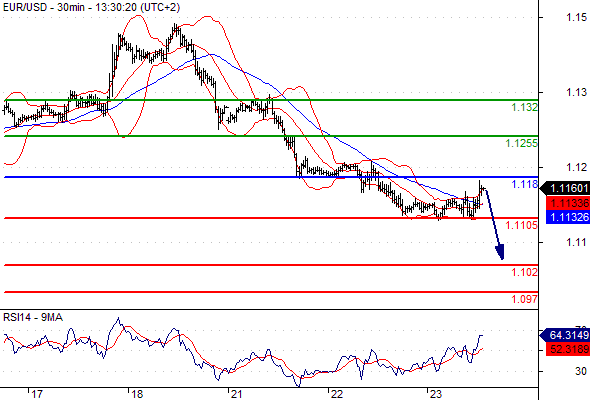

EURUSD

Pivot: 1.118

Likely scenario: Short positions below 1.118 with targets @ 1.1105 & 1.102 in extension.

Alternative scenario: Above 1.118 look for further upside with 1.1255 & 1.132 as targets.

Comment: As long as the resistance at 1.118 is not surpassed, the risk of the break below 1.1105 remains high

.GBPUSD

Pivot: 1.54

Likely scenario: Short positions below 1.54 with targets @ 1.524 & 1.52 in extension.

Alternative scenario: Above 1.54 look for further upside with 1.546 & 1.553 as targets.

Comment: The RSI is badly directed.

AUDUSD

Pivot: 0.709

Likely scenario: Short positions below 0.709 with targets @ 0.701 & 0.6985 in extension.

Alternative scenario: Above 0.709 look for further upside with 0.7115 & 0.716 as targets.

Comment: The RSI lacks upward momentum.

Leave A Comment