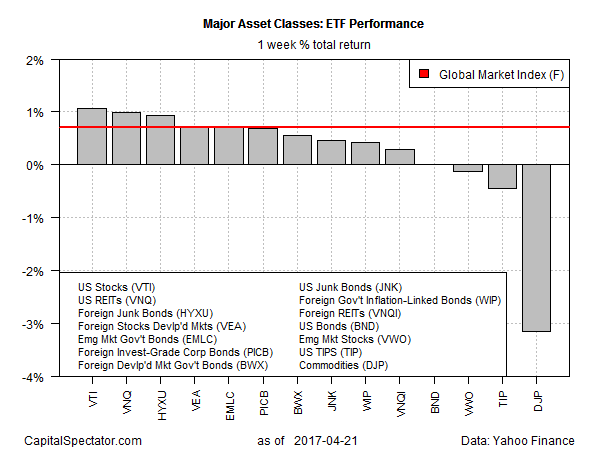

The US equity market scored its first weekly advance this month, delivering the top performance in April’s third week among the major asset classes, based on a set of exchange-traded products.

Vanguard Total Stock Market (VTI) increased 1.1% for the five trading days through Apr. 21, edging out the number-two performer: US real estate investment trusts via Vanguard REIT (VNQ), which gained 1.0%. VNQ’s gain, by the way, marks the fund’s sixth straight weekly advance.

Last week’s big loser: broadly defined commodities. iPath Bloomberg Commodity (DJP) slumped 3.2%, the biggest weekly setback since mid-March.

The generally bullish tone in markets lifted the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights climbed 0.7% last week, the first weekly gain for the benchmark so far this month.

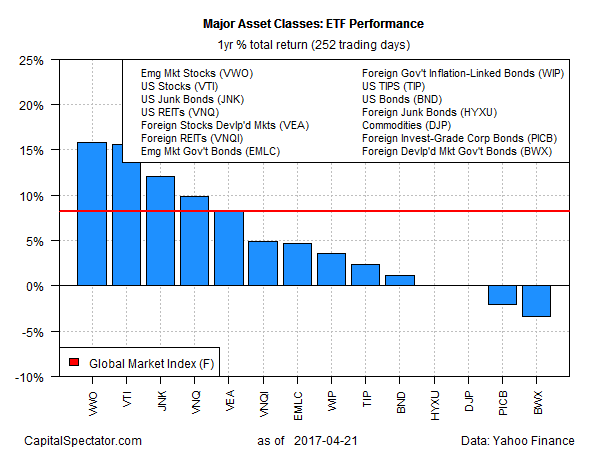

For one-year results, equities in emerging markets continue to hold the top spot, albeit just barely. Vanguard FTSE Emerging Markets (VWO) is currently sitting on a 15.9% total return for the 12 months through Apr. 21—fractionally ahead of US stocks based on VTI.

On the flip side, foreign government bonds in developed markets continue to suffer the biggest loss for the trailing one-year window. SPDR Bloomberg Barclays International Treasury Bond (BWX) is off 3.3% over the past 12 months through Friday.

Meantime, GMI.F’s one-year performance remains solidly positive. The benchmark’s total return for the past 12 months at last week’s close: 8.2%.

Leave A Comment