Continuing a theme we noted three weeks ago when we noted the record outperformance of the US stock market vs the rest of the world, Bank of America writes today that in August, the S&P 500 continued its nine-year-long trend of outperformance versus the rest of the world in August.

Fueled by the strongest macro backdrop in the US since the financial crisis, the MSCI All Country World Index ex-US fell 2.3% in August, with EPS declining 2.4% and the P/E slipping to 15.2x, in complete contrast to the S&P 500 hitting an all-time high with positive revisions and multiple expansion.

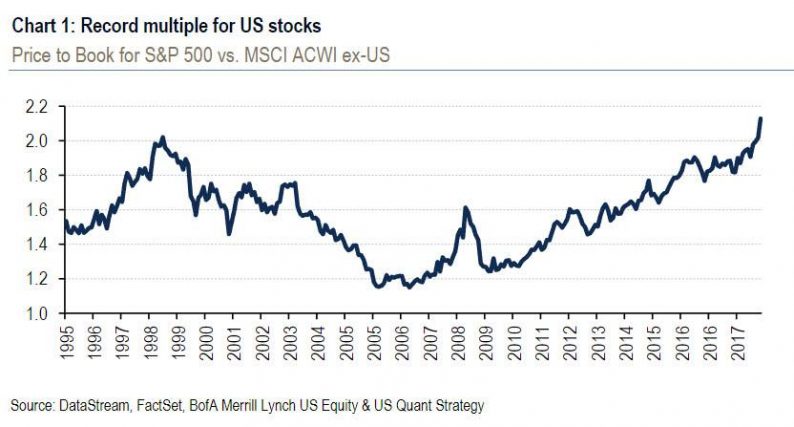

To show just how overvalued the US is relative to the rest of the world, on earnings, the S&P 500 now trades at a 12% premium to MSCI ACWI ex. The US, a high since 2009, and trades at a premium vs. each of the major global regions (Europe, Japan, and EM) concurrently for the first time since 2009. On book value, the S&P 500 trades at an all-time premium of 2.1x the MSCI ACWI ex. The US.

That said, fundamentals continue to support the US, as it is the only region with more positive earnings revisions than cuts. That has been noted by the market, as the S&P 500 forward P/E has risen for two straight months to 16.9x in August, as the market hit an all-time high during the quiet summer month, up 3% vs. a 1% rise in EPS.

As a result, the S&P’s P/E is now 11% above its long-term average and at the highest level since February. Stocks remain expensive versus history across most valuation metrics, except on growth, cash flow, and relative to bonds.

In fact, As the following table from BofA shows, stocks are now overvalued relative to history based on a vast majority of valuation metrics.

Leave A Comment