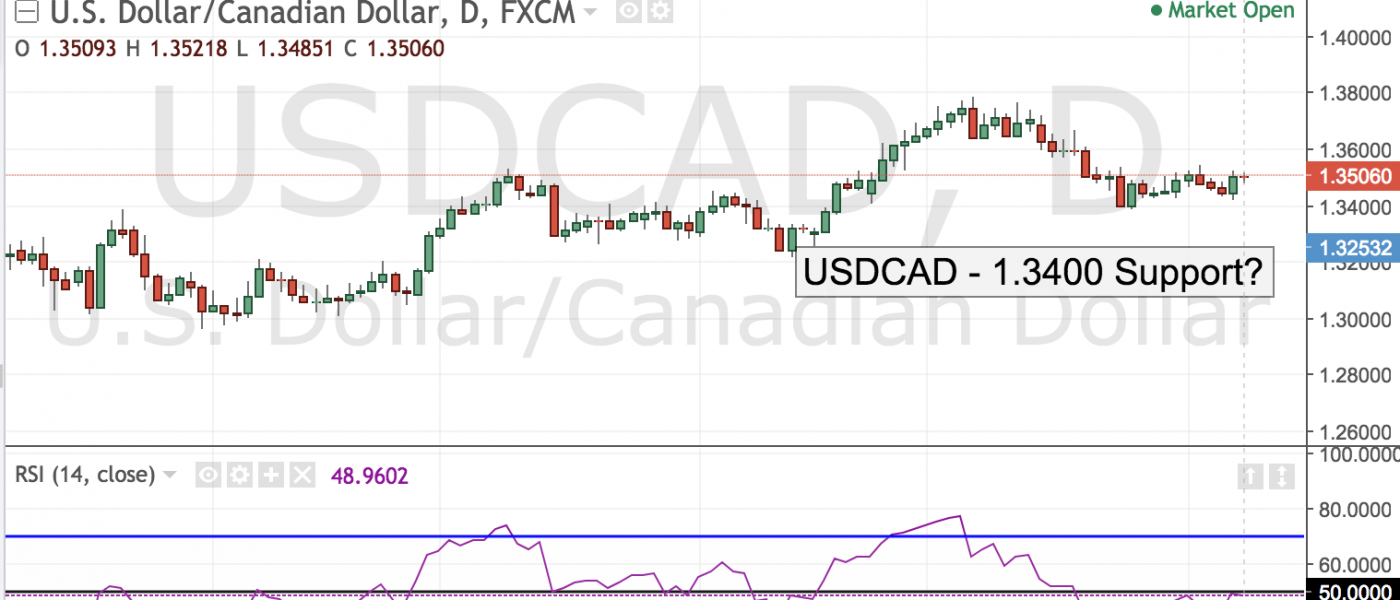

The collapse of oil has been the main driver behind loonie’s relative weakness this week. Crude crumbled to $45/bll level despite tensions in the Middle East as supply continues to weigh on the market. Meanwhile Canadian economy has seen mixed results with a rebound in GDP data, but softer housing and Trade Balance numbers.

Tomorrow Canada will release it labor report which will be the main event risk in North American session. The market is looking for 11.5K gain but if the number comes in worse or even negative, the loonie could shoot for the 1.3600 figure. For now, 1.3400 is very support and the pair remains in buy the dip mode.

Leave A Comment