The mix of inflation and retail sales releases in Canada hasn’t always been favorable for the Canadian dollar. In many cases, the data that fell short of expectations overshadowed the better than expected publication. And in other cases, both figures chased each other to the bottom.

This is not the case this time. CPI beat expectations with 21.% y/y, 0.1% better than expected. Core CPI missed with 1.5% but the core trim beat with 1.8% and the CPI median with 1.9%.

Retail sales leaped by 1.5% against 0.3% predicted. Excluding cars, it advanced by 0.8%, double the early projections. Other core measures of consumption were also upbeat.

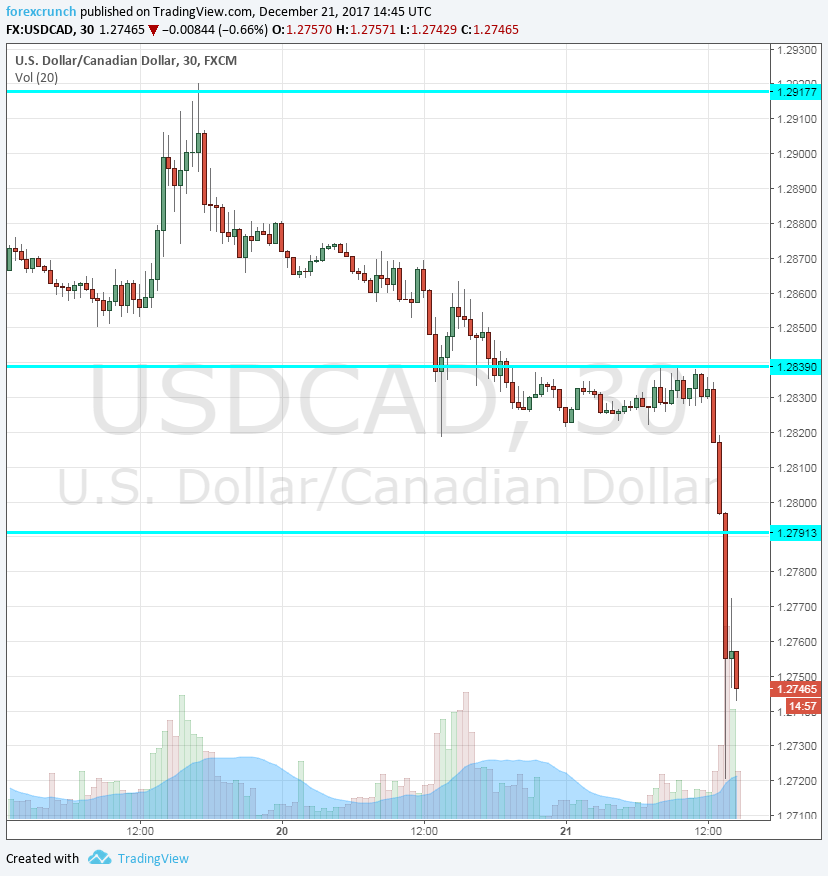

This one-two punch proved powerful. USD/CAD is down some 80 pips on the day, trading at 1.2746 at the time of writing. The graph clearly shows how the pair had traded in a steady manner prior to the big event before plunging.

Further support awaits at the round line of 1.27, followed by 1.2630. Resistance is at 1.2790 and 1.2840. The latter capped the pair earlier.

The loonie also got some help with a small miss on US GDP: 3.2% in the final read instead of a confirmation of 3.3%.

What’s next? We still have more data from the US coming out tomorrow, with durable goods orders and the Fed’s favorite inflation measure. However, in the past, we have seen how clear Canadian data have an impact long after the dust settles and new US data is released. Will 1.7 be challenged soon?

Leave A Comment