![]()

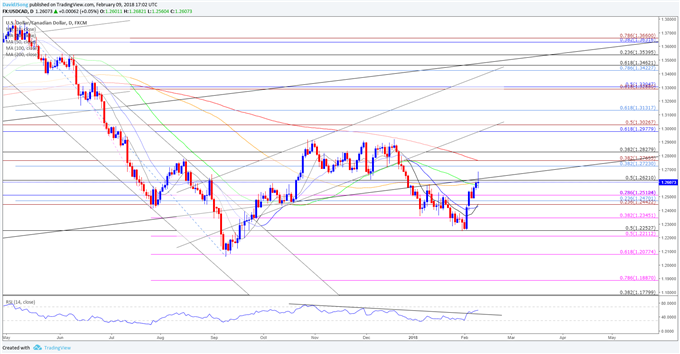

USD/CAD spikes to fresh monthly-high (1.2682) as Canada Employment contracts 88.0K in January, and the pair may continue to retrace the decline from late last year as it extends the series of higher highs & lows from earlier this week.

Bear in mind, a deeper look at the report showed the weakness was driven by a 137K decline in part-time positions, while full-time jobs increased 49.0K during the same period even as the labor force participation rate narrowed to an annualized 65.5% from 65.8% in December.

Signs of underlying strength in employment may keep the Bank of Canada (BoC) on course to further normalize monetary policy in 2018, but Governor Stephen Poloz and Co. may merely attempt to buy more time after implementing a dovish rate-hike at the start of the year as ‘some continued monetary policy accommodation will likely be needed to keep the economy operating close to potential and inflation on target.’ With that said, USD/CAD may continue to gain ground ahead of the Federal Open Market Committee (FOMC) interest rate decision on March 21 as the central bank is widely anticipated to deliver a 25bp rate-hike, but the fresh developments coming out of the U.S. economy may rattle the near-term advance in USD/CAD if the data prints instill a weakened outlook for growth and inflation.

Fresh updates to the U.S. Consumer Price Index (CPI) are anticipated to show a slowdown in both the headline and core reading for inflation, while Retail Sales are projected to increase a marginal 0.2% in January following a 0.4% expansion the month prior, and a batch of lackluster data prints may curb the recent recovery in the greenback as it undermines the Fed’s scope to implement three rate-hikes in 2018.

USD/CAD Daily Chart

Interested in trading? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Leave A Comment