Dollar/CAD moved up in a mixed week, trying to find a new direction amid sliding oil prices. Retail sales stand out in the upcoming week. Here are the highlights and an updated technical analysis for USD/CAD.

Canada’s manufacturing sales and foreign securities purchases both beat expectations but the first ADP jobs report showed a drop in jobs. BOC member Wilkins gave acknowledged that they did not expect the strong growth rate is not sustainable. American lawmakers are struggling to pass the tax cuts that they promised. On the other hand, inflation data beat expectations. Canadian inflation data came out as expected and did not impress.

Updates:

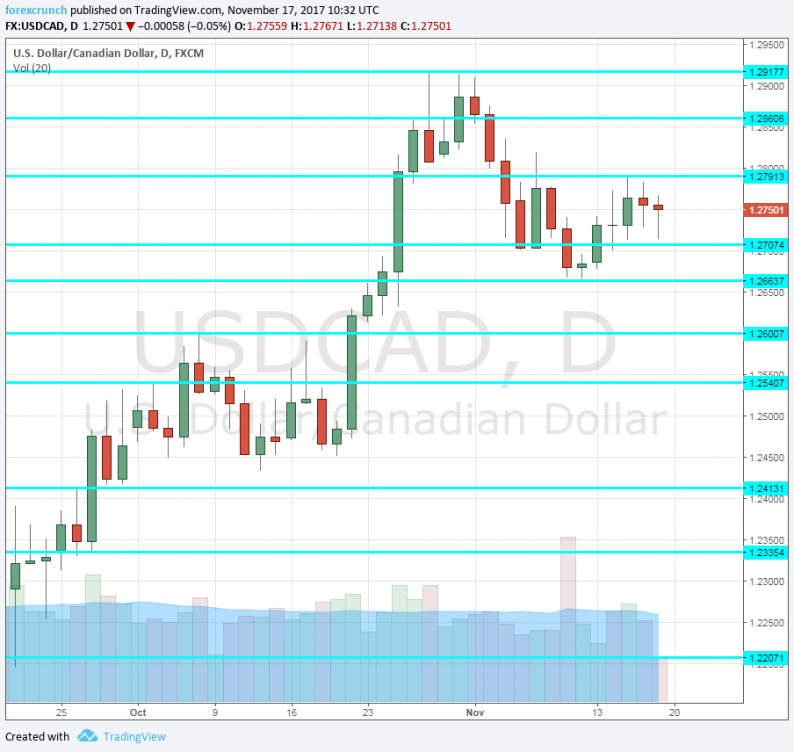

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD began the week by testing support at 1.2665, mentioned last week. From there is advanced to challenge 1.2770, trading in a perfect range.

Technical lines from top to bottom:

1.3160 provided support back in June. 1.3080 was a line of resistance to the pair in its recovery attempts in July.

1.2920 capped the pair in late October. It is followed by 1.2860 which worked as support back in July.

Leave A Comment