Dollar/CAD had a somewhat wild week: rising on NAFTA worries but dropping back down on upbeat Canadian GDP. The first week of October features the all-important jobs report. Where will the C$ go next? Here are the highlights and an updated technical analysis for USD/CAD.

The US wants to move forward with the agreement with Mexico, excluding Canada. They want to ratify the deal before Lopez Obrador takes over as Mexico’s President. The news sent the loonie lower. On the other hand, Canadian GDP came out at 0.2% m/m in July, slightly above expectations, allowing a recovery. BOC Governor Stephen Poloz repeated the message of gradual rate hikes while saying that Canada is less dependent on the US than 15 years ago. US data was OK, with few surprises.

Updates:

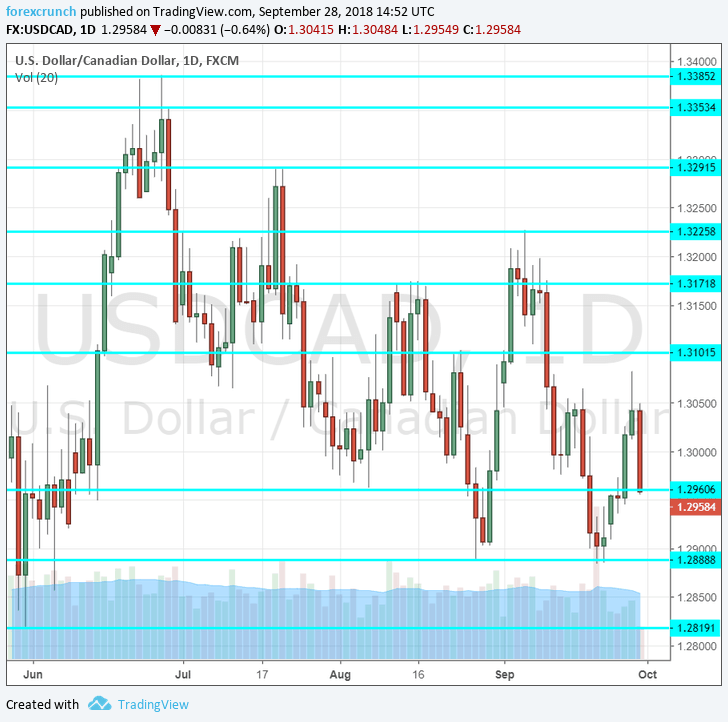

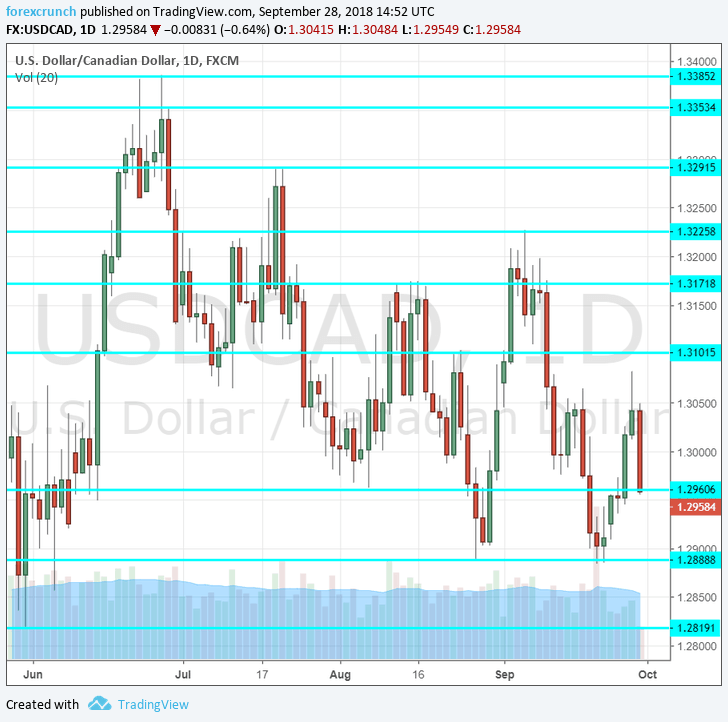

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD started the week with an upside move but dropped and found itself around 1.2960 (mentioned last week).

Leave A Comment