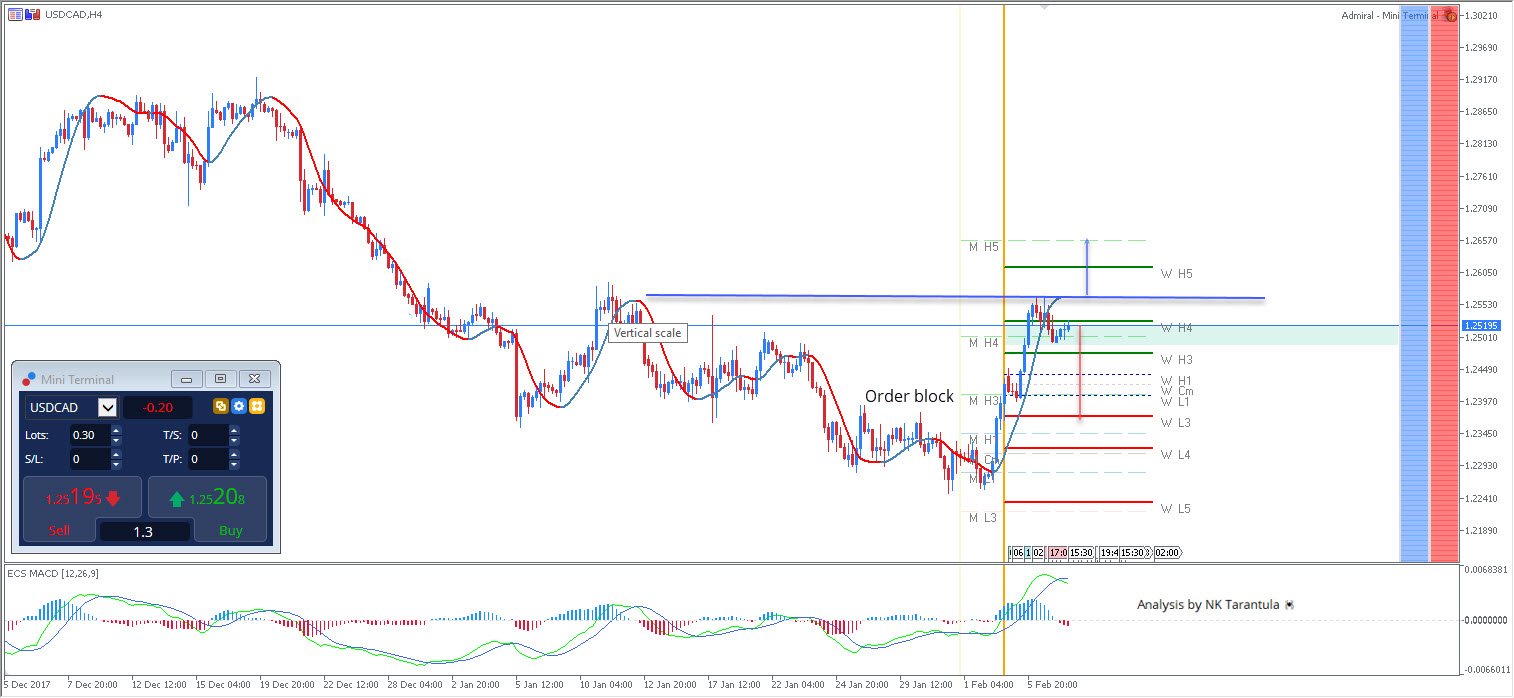

Source: Admiral Markets MT5 with MT5SE Add-on

The USD/CAD has been in a retracement mode but without an additional momentum to break recent highs. The pair is making a lower high now and if 1.2560 holds we might see a U-turn on the price. Targets are W H3 and W L3 levels – 1.2468 and 1.2376, but in the case you are trading intraday pay attention to W H1 – W L1 levels 1.2437 and 1.2405 respectively. A spike above 1.2560 could turn the price bullish again targeting 1.2606 and 1.2653.

W H1 -. Weekly Camarilla Pivot (Interim resistance – Weak)

W H2 – Weekly Camarilla Pivot (Weekly resistance)

W H3 – Weekly Camarilla Pivot (Weekly resistance – main)

W H4 – Weekly Camarilla Pivot (Strong Weekly Resistance)

W L4 – Weekly Camarilla Pivot (Interim support – Strong)

W L3 – Weekly Camarilla Pivot (Interim support – Main)

W L2 – Weekly Camarilla Pivot (Interim support)

W L1 – Weekly Camarilla Pivot (Interim support – Weak)

POC – Point Of Confluence (The zone where we expect the price to react aka entry zone).

Leave A Comment