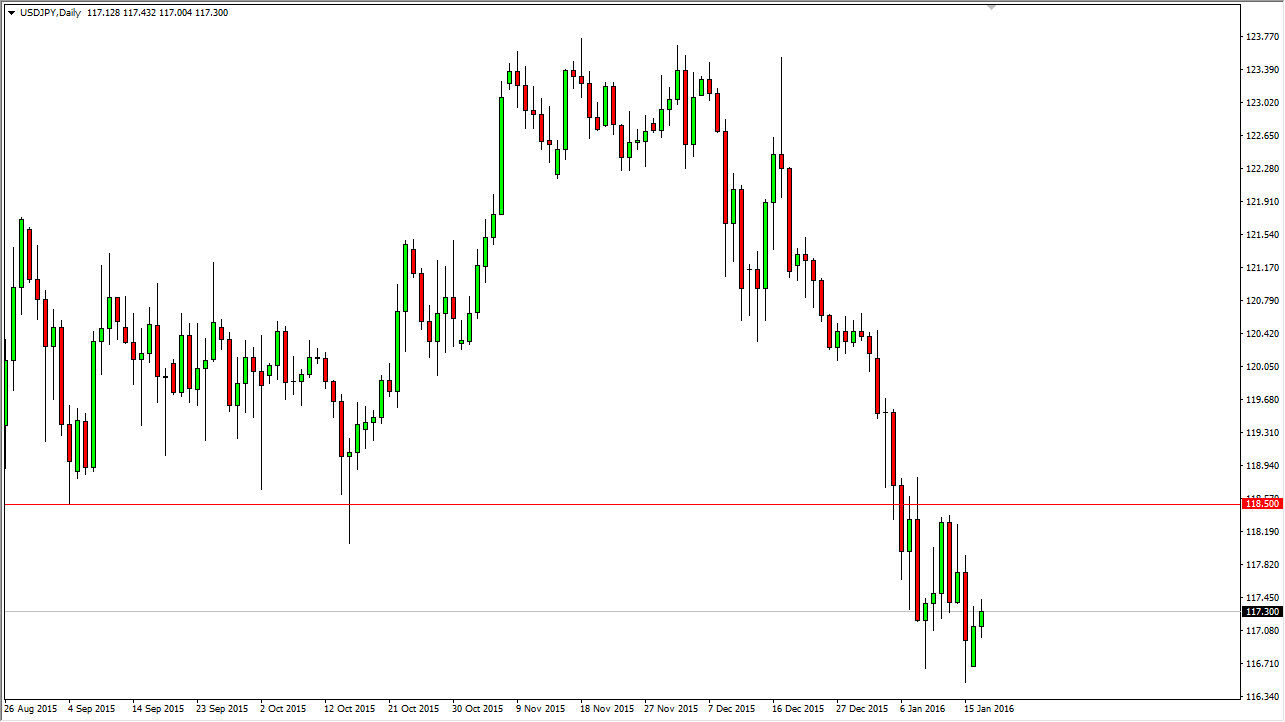

The USD/JPY pair initially gapped lower at the open on Monday morning, but then shot higher as the market continues to find buyers at lower levels. However, this isn’t to say that I believe that this market will certainly see a lot of buying pressure, just that we are heading back to the top of the consolidation area at the 118.50 level. I think we can break above there, that of course means very bullish things for the US dollar against the Japanese yen, but in the meantime very likely that we just continue to do what we’ve done of the last several sessions – consolidate.

Longer-term, yes I believe that we break out to the upside but it’s probably not going to happen right away. I think that the 115 level below is a massive support barrier and essentially defined the trend. As long as we can stay above there, I believe that this market will ultimately see buyers come back into play. Having said that, at the moment global risk appetite is a bit too soft to see a lot of bullish pressure here. Because of this, I believe that short-term rallies will be nice selling opportunities today.

AUD/USD

The AUD/USD pair certainly shows that there is a significant amount of risk appetite distraction around the world right now, as the Australian dollar is being shunned by just about everybody. Keep in mind that the Australian dollar is quite often used as a proxy for China, and China has been acting absolutely horribly lately. With that being the case, I believe that there will be continued pressure to the downside on the Aussie dollar, and that we will eventually fall to fresh, new lows. I think the 0.65 level is where we’re going given enough time, and in the meantime I’m willing to sell rallies on short-term charts in order to take advantage of perceived value in the US dollar.

Leave A Comment